NCERT Solutions for Class 12 Economics Chapter 6 Open Economy Macroeconomics – Macroeconomics updated for CBSE and State board session 2025-26. Class 12 Macroeconomics chapter 6 important extra question answers and Case Studies MCQ with explanation are also given here for exams.

NCERT Solutions for Class 12 Economics Chapter 6

Class 12 Macroeconomics Chapter 6 Open Economy Macroeconomics Question Answers

Open economy – Class 12 Macroeconomy Chatper 6

An open economy is one that interacts with different countries through varied channels. So far, we tend to had not thought-about this facet and simply restricted to a closed economy within which there are not any linkages with the remainder of the planet as so to change our analysis and justify the fundamental macroeconomic mechanisms. In reality, latest economies are open. There are 3 ways within which these linkages are established. 1. Output Market: Associate economy will change products and services with different countries. This widens selection within the sense that buyers and producers will choose from domestic and foreign products. 2. Monetary Market: Most frequently associate economy should purchase monetary assets from different countries. This provides investors the chance to settle on between domestic and foreign assets.

3. Labour Market: Corporations will select wherever to find production and staff to settle on wherever to work. There are varied immigration laws that limit the movement of labour between countries. Movement of products has historically been seen as a substitute for the movement of labour. We tend to specialize in the primarily 2 linkages. Thus, associate open economy is alleged to be one that trades with different nations in products and services and most frequently, conjointly in monetary assets. Indians as an example, will consume products that are created round the world and a few of the products from Asian countries are exported to different countries.

Foreign trade, therefore, influences Indian aggregate demand in 2 ways in which, First, once Indians gets foreign product, this disbursal escapes as a leak from the circular flow of financial gain decreasing aggregate demand. Second, our exports to foreigners enter as associate injection into the circular flow, increasing aggregate demand for products created inside the domestic economy. Once product move across national borders, cash should be used for the transactions. At the international level there’s no single currency that’s issued by even one bank.

Class 12 Macroeconomics – The Balance of Payments

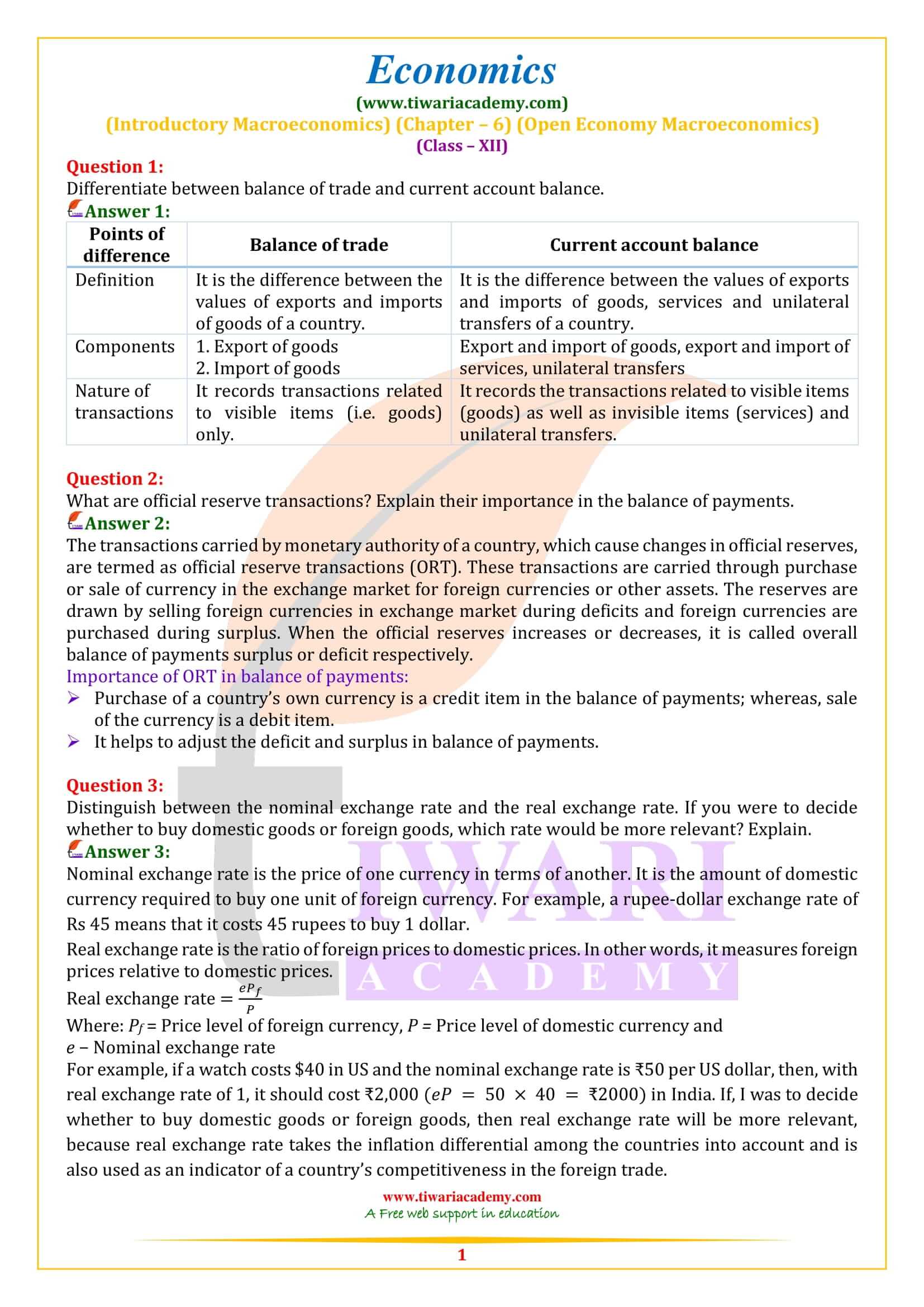

The balance of payments records the group action in product, services and assets between residents of a rustic with the remainder of the planet for a particular time period usually a year. There are 2 main accounts within the balance of payments: Current account and Capital account. Current Account: It’s the record of exchange products and services and transfer payments. Exchange product embody import and export of the products. Exchange services includes factor financial gain and non-factor financial gain transactions.

Transfer payments are the receipts that the residents of a rustic get for ‘free’, while not having to supply any products or services reciprocally. They contain gifts, remittances and grants. They may be by the govt or by personal voters living abroad. Shopping for foreign product is expenditure from our country and it becomes financial gain of the foreign country. Hence, the acquisition of foreign product or imports decrease the domestic demand for product and services in our country. Similarly, marketing of foreign product or exports brings financial gain to our country and adds to the combination domestic demand for products and services in our country.

Capital Account: It records all international transactions of assets. An asset is any one of the forms during which wealth will be controlled, for example: cash, stocks, bonds, government debt, etc. Purchase of assets could be a debit item on the capital account. If an Indian buys a Britain’s car company, it enters capital account transactions as a debit item. On the opposite hand, sale of assets like sale of share of an Indian company to a Chinese client could be a credit item on the capital account. Capital account is in balance once capital inflows are equal up to capital outflows. Surplus within the capital account arises when capital inflows are lesser than the capital outflows.

Balance of Payments surplus and Deficit

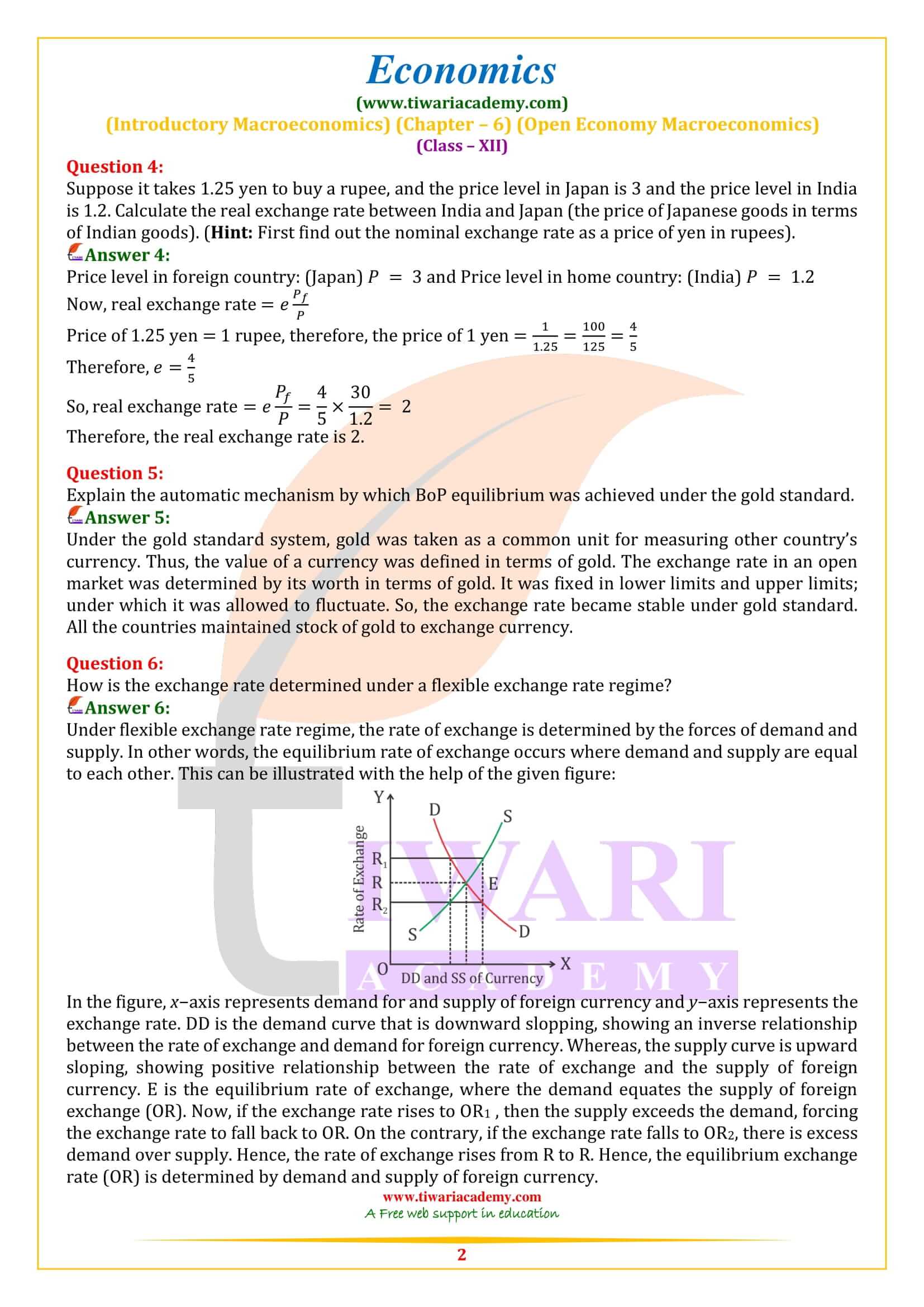

The essence of international payments is rather like a private who spends over his financial gain should finance the distinction by selling assets or by borrowing, a rustic that incorporates a deficit in his current account must finance it by selling assets or by borrowing from abroad. Thus, any current account deficit should be supported by a capital account surplus, that is, a net capital inflow. In a case, a rustic is claimed to be in balance of payment equilibrium, this current account deficit is supported entirely by international loaning with none reserve movements. Instead, the rustic (country) would use its reserves of foreign exchange so as to balance any deficit in its balance of payments.

The reserve bank sells foreign exchange once there’s a deficit. This can be known as official reserve sale. The decrease or increase in official reserves is termed the balance of payment deficit or surplus. The fundamental premise is that the financial authorities are the final word financers of any deficit within the balance of payments. International economic transactions are known as autonomous when transactions are made because of some reason apart from to bridge the gap within the balance of payments, that is, after they freelance of the state of balance of payments. One reason might be to earn profit. These things are called ‘above the line’ things within the balance of payments.

The balance of payment is claimed to be in surplus or deficit, if autonomous receipts are larger but autonomous payments. Accommodating transactions, on the opposite hand, are determined the gap within the balance of payments, that is, whether or not there’s a deficit or surplus within the balance of payments. In alternative words, they’re determined by the net consequences of the autonomous transactions. Since the official reserve transactions are created to bridge the gap within the balance of payments, they’re seen as the accommodating item in the balance of payments.

How far is microeconomics which student has studied in class 11th relevant to the study of macroeconomics of class 12th?

Though theoretically microeconomics and macroeconomics are interrelated subjects, though studying microeconomics gives you glimpse of economics- however, practically speaking macroeconomics is completely a different ball game. To give an example, algebra and geometry seem to be different. However, both are needed in higher classes. Similarly, to become an adept in the subject economics you need to thoroughly understand both.

I am told by my seniors that macroeconomics is very tough. Is it a correct statement?

For a student having a fair bit of knowledge of algebra and geometry and reasonable grasp over the language, the subject macroeconomics class 12th is not a very challenging task.

Should a student have good knowledge of algebra and geometry to work out the numerical and understand the graphs?

The basic knowledge of algebra and geometry is needed. However, you are not required to give proofs for theorems. So far as class 12th is concerned, you may just have to solve simple equation in one or two unknowns- certainly not quadratic equations. You just need to know how points are plotted on the graph paper.

Are there any choice questions in numerical and graphs in the Board exams?

As per CBSE norms, there is possibility that 33 % of question carry choice. Choice may be available in theory questions as well as numerical- that depends on the examiner.