NCERT Solutions for Class 12 Economics Chapter 5 Government Budget and the Economy – Macroeconomics designed and developed for session 2025-26023. Along with the solutions, student can get here class 12 Macroeconomics chapter 5 MCQ, Case Studies and extra question answers.

Class 12 Economics Chapter 5 Solutions

Class 12 Macroeconomics Chapter 5 Macroeconomics Government Budget and the Economy Question answers

12th Macroeconomics – Government budget

There is a constitutional demand in Republic of India to present before the Parliament, an announcement of calculable receipts and expenditure of the govt in respect of each financial year which runs from 1st April to 31st March. This ‘Annual Financial Statement’ represent the primary budget document of the govt. The govt plays an awfully vital role in increasing the welfare of the people. Government provides certain goods and services that can’t be provided by the market mechanism, i.e.; by exchange between individual shoppers and producers.

Example of such merchandise are national defence, roads, government administration, etc., that are noted as public goods. To grasp why public merchandise, got to be provided by the govt, we must understand the difference between non-public merchandises such as garments, cars, food items, etc. and public merchandise. The benefit of public goods is available to all and not restricted to one particular user. Think about a public park or measures to scale back pollution, the advantages are obtainable to all or any. Just in case of personal merchandise, anyone who does not pay to obtain the product, can be excluded from enjoying its advantages. Like, if you don’t buy a ticket of the movie, you may not be allowed to enter the cinema hall.

However, in case of public merchandise, there is no possible approach of excluding anyone from enjoying the advantages of the product. That is why public merchandise is known as non-excludable. Even if some users do not pay, it’s tough and typically not possible to gather fees for the general public merchandise. These non-paying users are known as ‘free-riders’. There is, however, a distinction between public provision and public production. Public provision implies that they’re finances through the budget and may be used with none direct payment. Public merchandise could also be created by the govt or the non-public sector. When goods are created directly by the govt, it is known as public production.

Classification of receipts in 12th Macroeconomics

Revenue receipts: These receipts are those receipts that don’t lead result in a claim on the govt. They’re thus termed non-redeemable. They’re divided into tax and non-tax revenues. Taxation, a vital element of revenue receipts, have for long been divided into direct taxes and companies, and indirect taxes like excise taxes, custom duties and service taxes. Alternative direct taxes like wealth tax, gift tax and state duty haven’t brought in a great deal of revenue and therefore are remarked as paper taxes. The distribution objective is wanted to be achieved through progressive financial gain taxation, within which higher the financial gain, higher is that the rate. Companies are taxed on a proportional basis, wherever the rate could be an explicit proportion of the profits.

With respect to excise taxes, requirements of life are exempted or taxed at low rates, comforts and semi-luxuries are moderately taxed and luxuries, tobacco and fossil fuel merchandise are taxed heavily. Non-tax revenue of the central government primarily consists of interest receipts on account of loans by the central government, dividends and profits on investments created by the govt, fees and alternative receipts for services rendered by the govt. Money grant-in-aid from foreign countries and international organisations are enclosed. The estimate of revenue receipts takes into accounts the consequences of tax proposal created within the finance bill.

Capital receipts

The govt additionally receives cash by means of loans or from the sale of its assets. Loans can need to be returned to the agencies from that they have been borrowed. Thus, they produce liability. Sale of presidency assets, like sale of shares in Public Sector Undertakings, that is remarked as PSU withdrawal, cut back the whole quantity of monetary assets of the govt. All those receipts of the govt that produce liability or cut back monetary assets are termed as capital receipts.

Classification of Expenditure – Class 12 Macroeconomics

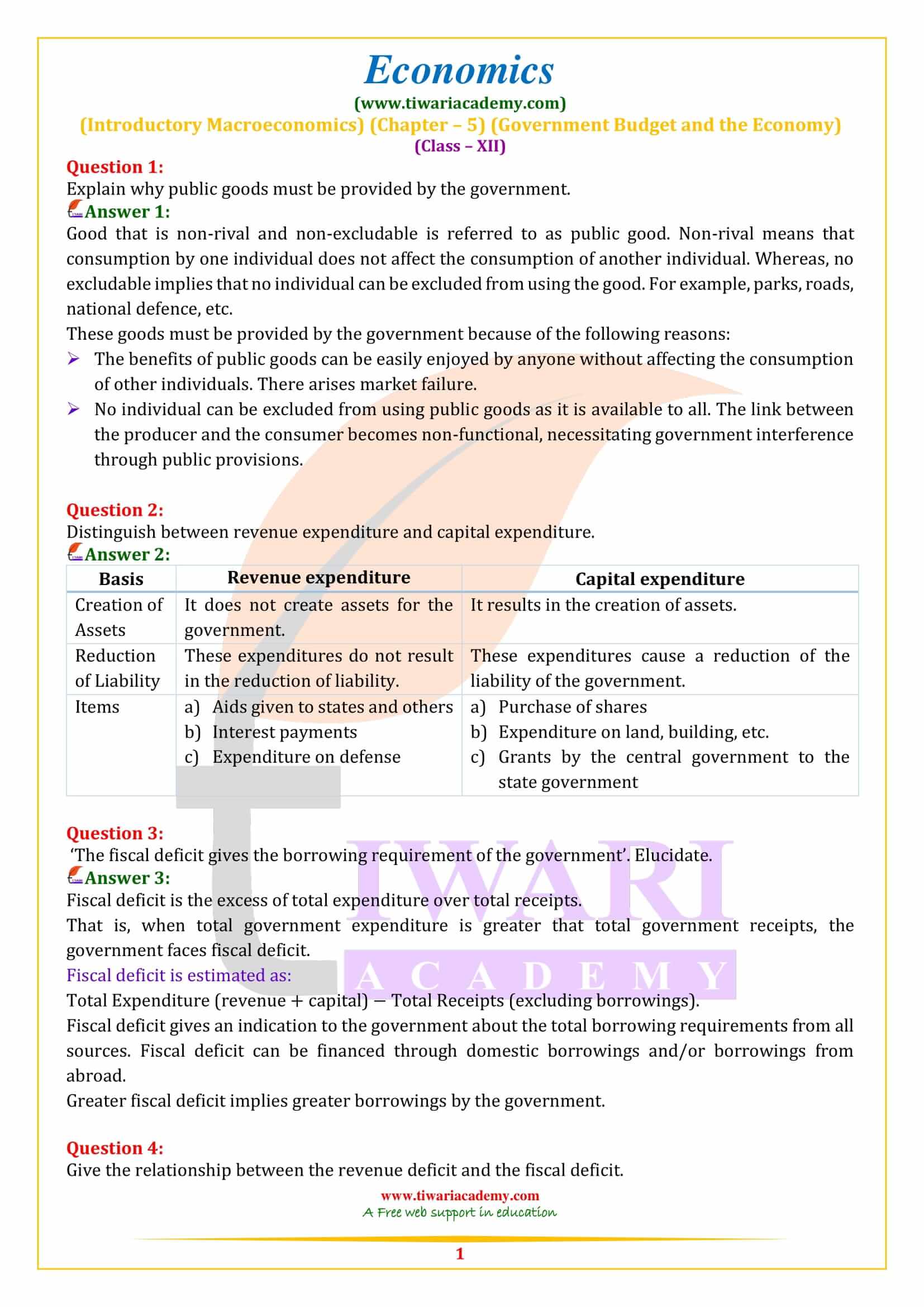

Revenue expenditure: It is an expenditure incurred for purposes other than the creation of physical or financial assets of the central govt. It relates to those expenses incurred for the normal functioning of the govt departments and various services, interest payment on debt incurred by the govt, and grants given to state govt and other parties. Budget documents classify total expenditure into planned and non-planned expenditure. By this classification, planned revenue expenditure relates to the central plans and central assistance for state and union territory plans.

Non-plan expenditure, covers a vast range of general, economic and social services of the govt. The main items of non-plan expenditure are interest payments, defence services, subsidies, salaries and pensions. Interest payments on market loan, external loans and from various reserve funds constitute the single largest component of non-plan revenue expenditure. Defence expenditure, is committed expenditure in the sense that given the national security concerns, there exists little scope for drastic reduction. Subsidies are an important policy instrument which aims at increasing welfare. Apart from providing implicit subsidies through under-pricing of public goods and services like education and health, the government also extends subsidy explicitly on items such as exports, interest on loans, food and fertilisers.

Capital expenditure

There are expenditure of the govt which result in creation of physical or financial assets or reduction in financial liabilities. This includes expenditure on the acquisition of land, building, machinery, equipment, investment in shares, and loan and advances by the central govt to state and union territory govts, PSUs and other parties. Capital expenditures are also categorised as plan and non-plan in the budget documents. Plan capital expenditure, like its revenue counterpart, relates to central plan and central assistance for states and union territory plans. Non-plan capital expenditure covers various general, social and economic services provided by the govt.

What are the important topics of class 12 Macroeconomics chapter 5?

Class 12 Macroeconomics chapter 5 carries 6 marks according to CBSE board- split into two sub topics namely Foreign exchange and balance of payment. There are three systems of Foreign exchange determination. India follows the managed floating system. We study the merits and demerits of the fixed exchange system and the flexible exchange system. We try to understand what determines the demand and supply of foreign exchange in a flexible exchange rate system, We can also understand and appreciate the benefits/consequences of devaluation/ depreciation of currency.

In the topic Balance of Payment (which is the concluding chapter of macroeconomics), we study the components of BOP namely the current account and the capital account. The current account deficit (CAD) can and does have adverse consequences on the overall BOP possession and foreign exchange rate (particularly the US Dollar).

Numerical on calculation on BOT, current account deficit, devaluation of currency can also be asked in the Board examination- though the marks allotted would be 1 or 2.

Students should note that these two sub-topics namely Balance of Payment and Foreign exchange are interrelated. Any deficit in BOP affects the foreign exchange rate adversely. Hence, these two have been combined into one unit.

What are the main concepts to prepare 12th Macroeconomics chapter 5?

The important concepts in the topic determination of foreign exchange are- Foreign exchange rate, Foreign exchange market, Devaluation, Depreciation, Revaluation and Appreciation of currency, Speculation, demand for foreign currency and supply of foreign currency.

The important concepts in BOP are current account, Capital account, BOT, Autonomous items, accommodating items, disequilibrium in BOP, surplus or deficiting BOP, visible and invisible items in current account, Unilateral transfers.

Which questions, in chapter 5 of 12th Economics, are considered as most important for examination perspective?

- Discuss the concepts of: (2 marks each)

(a) Fixed exchange rate system

(b) Flexible exchange rate system

(c) Managed floating rate system. - Discuss the major reasons for demand (outflow) and supply (inflow) of foreign exchange.

(4 marks) - Distinguish between: (2- 3 marks each)

(a) Devaluation and depreciation of domestic currency

(b) Revaluation and Appreciation of Domestic Currency. - What is the meaning of balance of payments? State its main components (3 marks)

- Distinguish between Autonomous items and Accommodating items. (3 marks)

- What is meant by deficit in balance of payments? How is it corrected? (3 marks)

What are the main Abbreviations in class 12 Macroeconomics chapter 5 to learn?

- BOP = Balance of payment

- BOT = Balance of trade

- CAD = Current account deficit

- NRI = Non – resident Indian

- CAS = Current account Surplus

- TCS = Tata consultancy services

- MNC = Multi-national corporations