NCERT Solutions for Class 12 Economics Chapter 2 National Income Accounting – Macroeconomics updated for new academic session 2025-26. Class 12 Macroeconomics chapter 2 important questions and MCQ – Multiple Choice Questions are helpful for CBSE and State board Students.

Class 12 Economics Chapter 2 Solutions

Class 12 Economics Macroeconomics Chapter 2 National Income Accounting Question Answers

Basic concepts of Macroeconomics

The economic wealth or well being of a country does not only depend on mere possession of the resources, but in what way these resources are used in generating a flow of production and also the wealth and income are generated through this. In modern times, this flow is generated by countless small and large enterprises. These enterprises range from giant corporations employing a large number of people to single entrepreneur. After producing the commodities, each producer of the commodity intends to sell his output. Any smallest item like buttons or any largest item like airplane or any service which is sellable, like doctor, lawyer, etc. are produced to sell to the consumer. The consumer may be an individual or an enterprise and the goods or services purchased by him may be for the final use or for use in further production.

If it is used in further production, it often losses it’s characteristic as that specific good and is transformed through a productive process into another good. For example: A farmer producing cotton sells it to the spinning mill where the raw cotton undergoes transformation into yarn, then the yarn is sold to a textile mill where it is transformed into a cloth, then the cloth goes through another productive process to become a clothing article, and is then ready to be sold to the consumers for final use. There are other goods that are durable and used in the production process, such as tools, machinery, etc. While they perform in production of other goods, they themselves do not transform in the production process. They are also final goods for the consumer but they are not for consumption. These goods are the backbone of any production process, in aiding and enabling the production to take place. These goods are a part of the capital and one of the crucial factors of production in which a productive enterprise has invested.

Circular Flow of Income and Methods of calculating National Income

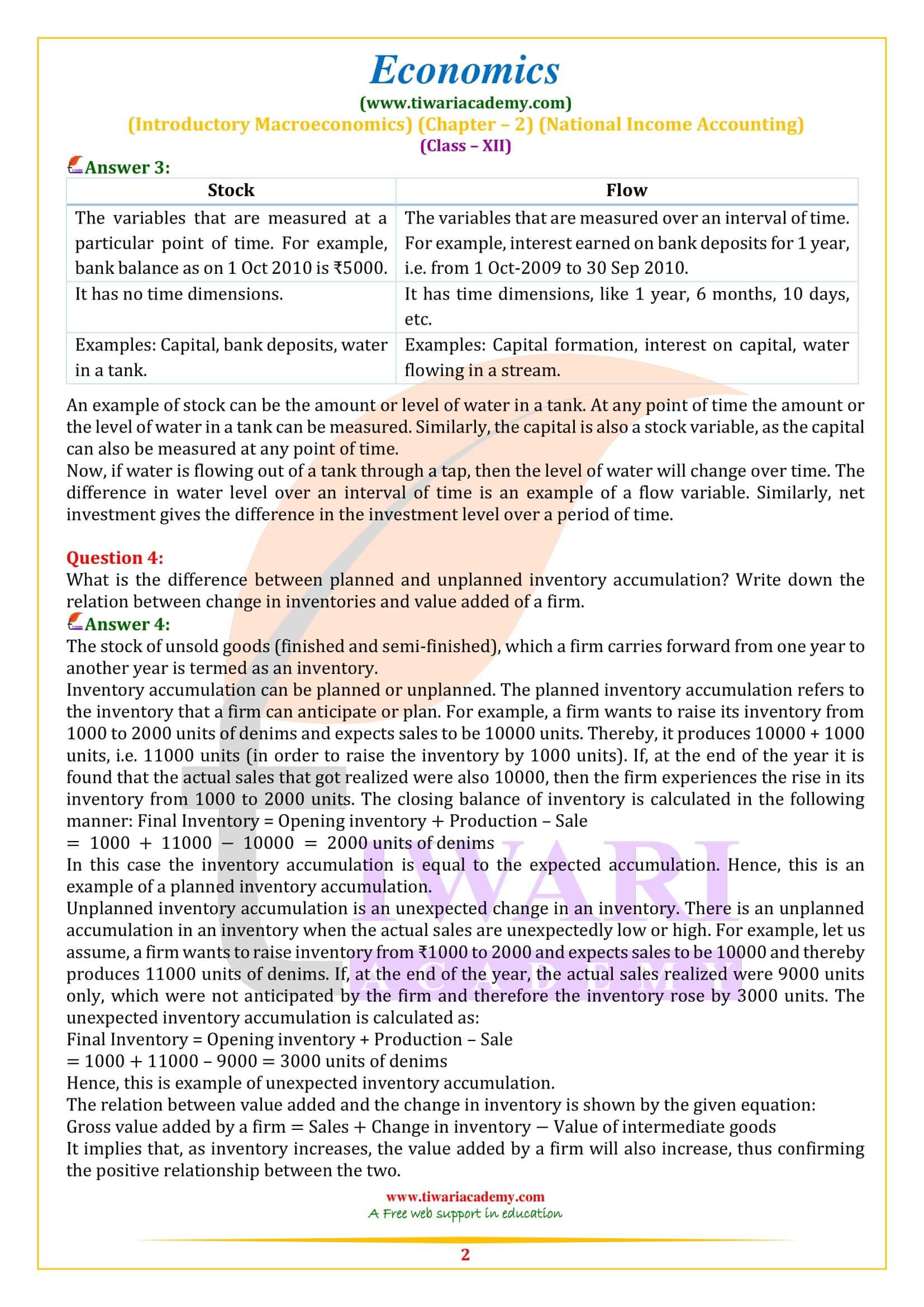

A household receive their payments from the firms for productive activities they perform for the latter. As we know that there may fundamentally be four kinds of contribution that can be made during the production of goods and services.

- Contribution made by human labour, remuneration of which is called wages.

- Contribution of capital, remuneration of which is called interest.

- Contribution made by entrepreneurship, remuneration of which is called profit.

- Contribution made by fixed natural resources as land, remuneration for which is called rent.

In this economy, there is only one way that a household may dispose off their earnings- by spending their entire income on the goods and services produced by the domestic firms. Every other means of disposing their income is closed. By this we have assumed that they do not save, neither they pay taxes as there is no government. And as there is no government, they can’t buy imported goods as there is no external trade in this simple economy. So, we can say that the aggregate consumption of the households in the economy is equal to the aggregate expenditure on goods and services produced by the firms in the economy.

The entire income of the company, therefore, comes back to the producers in form of revenue. Next, the firms will again produce the goods and services and pay remuneration to the factors of production. This remuneration will again be used to buy goods and services. And it will continue like that. So, we can say that the aggregate income of the economy is going through two sectors: firms and households, in a circular way. This means that when a firm produces goods and services, it sells it to the consumers, and when the consumers buy those goods and services, the firm gets the remuneration which again is used to produce the goods and services, and also covers the expenses of the producing factors.

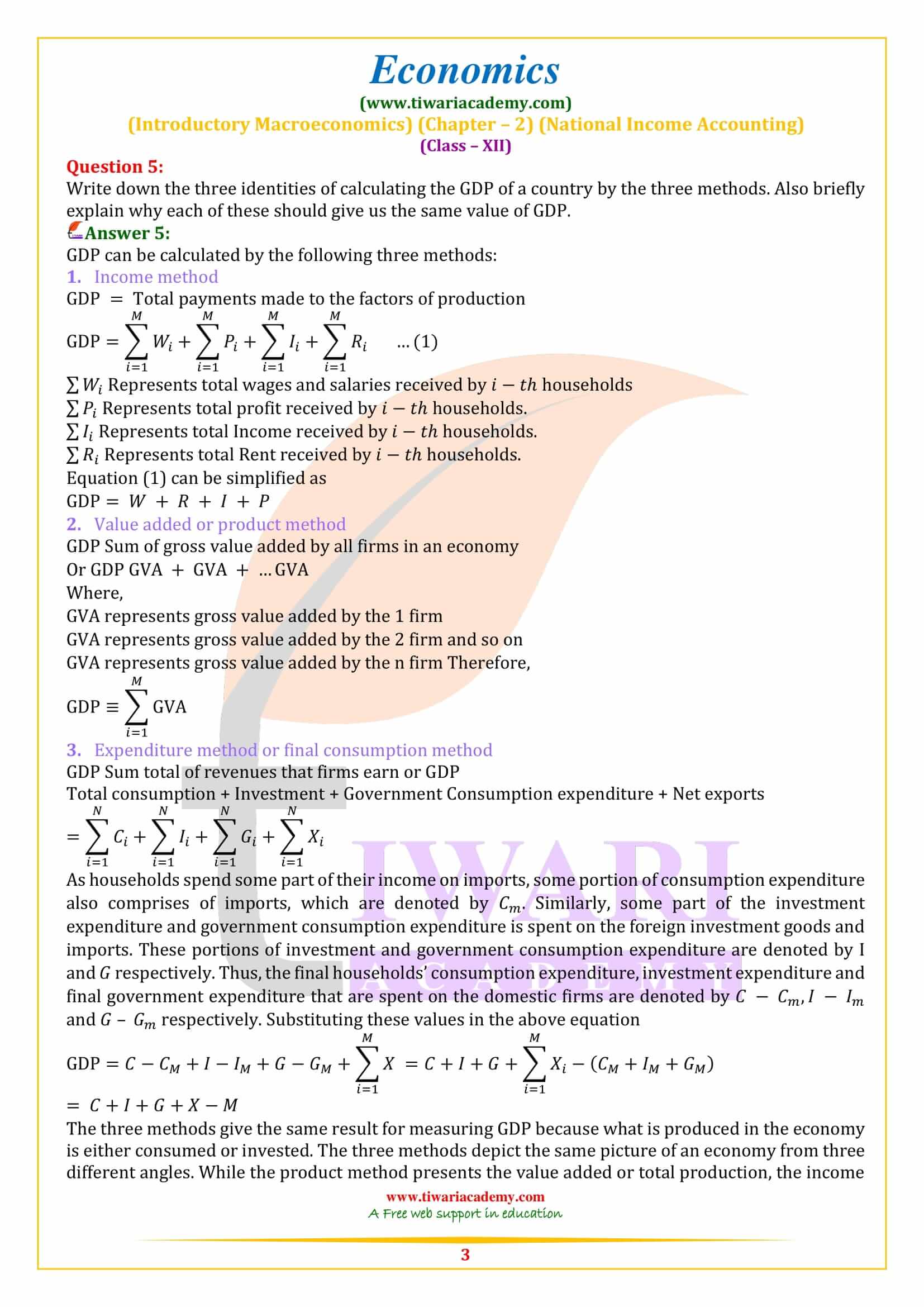

Nominal and Real GDP

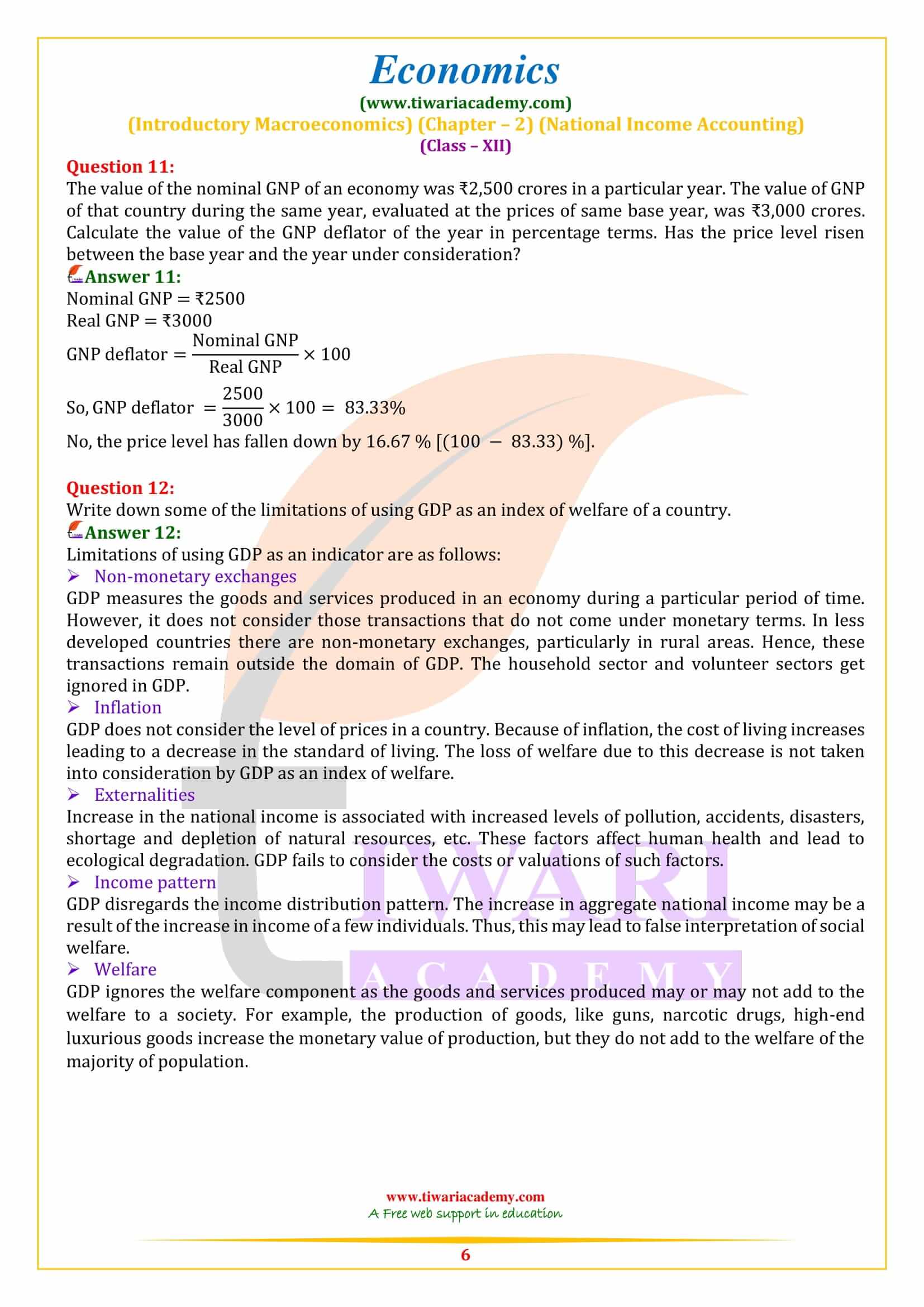

The one thing which we are assuming in all these discussions is that the prices of goods and services do not change during the period of our study. If they change, then it would be difficult comparing GDPs. If we measure the GDP of a country in two consecutive years and see that the figure for GDP of the latter year is twice that of the previous year, we may come to the conclusion that the volume of production of the country has doubled. But it is also possible that only prices of all goods and services have doubled between the two years whereas the production has remained the same.

So, while comparing the GDP figures of different countries or to compare the GDP figures of the same country at different points of time, we cannot rely on GDPs evaluated at current market prices. For comparison we take the help of real GDP. Real GDP is calculated in such a way that the goods and services are evaluated at some constant set of prices. Since these prices remain fixed, if the Real GDP changes, we can be sure that it is the volume of production which is changing, because the prices are fixed and still the GDP has doubled, it indicates that the volume of production has also been doubled. Nominal GDP, on the other hand, is simply the value of GDP at the current ongoing prices.

It is to be noted that there are two sets of prices for every commodity. One is the retail price which the consumer actually pays. The other is the wholesale price, the price at which goods are traded in bulk. These two may differ in value because of the margin kept by traders. Goods which are traded in bulk are not purchased by ordinary consumers but the wholesaler. The index for wholesale prices is called Wholesale Price Index (WPI).

What are main topics in Class 12 Economics Chapter 2 Macroeconomics?

This chapter consist of two parts namely money and its functions, measures of money supply, limitations of barter system on the one hand and banking including the functions of Central Bank. The point to be carefully noted is that the functions of commercial banks may be part of syllabus for some examination Boards while it may not be so for others. We suggest that students should understand the functioning of commercial banks even though it may not be the part of syllabus in certain Boards. Then only they will be able to appreciate the distinction between a commercial bank and Central bank. Similarly, the various concept of money supply namely M1, M2, M3 and M4 may not be part of syllabus for some Boards. The topic on function of Central bank includes Credit control policies/Monetary policies of the Central Bank.

The Monetary policies of the Central bank in India (RBI) are reviewed once in two months. Out of the 7 policies which are part of CBSE syllabus for 2022 –2023, the REPO rate is the most important.

How to prepare the Important Concepts of chapter 2 in 12th Macroeconomics?

The concept of money and money supply, difference between a commercial bank and a Central Bank, The various Credit control measures adopted by the RBI, namely- Bank rate, REPO rate, Reverse REPO rate, SLR, OMO, Margin and CRR must be mastered because these are important even for higher classes, competitive exams and interviews/ VIVA class 12th. Students should be careful in the exam because the same measures like CRR/ SLR work in a different direction when there is deficient demand. Said in other words, it should be carefully noted whether the question relates to control of excess demand or control of deficient demand.

It will be pertinent to note that the concept of Credit creation by commercial banks is new to students and must be read and revised thoroughly.

What are the most important questions for board exams?

(i) What are the functions of money? (4 marks)

(ii) What are the limitations of Barter system? (4 marks)

(iii) How does the Central bank control credit in an Economy through one or more measures? (3 – 6 marks)

(iv) Explain the process of money creation/ Credit creation by commercial banks. (6 marks)

(v) How does the Central Bank act as banker to the other Banks and to the Government? (4 marks)

(i) CRR = Cash Reserve Ratio

(ii) SLR = Statutory Liquid Ratio

(iii) LRR = Legal Reserve Ratio

(iv) OMO = Open Market Operations

(v) RBI = Reserve bank of India