NCERT Solutions for Class 12 Business Studies Chapter 10 Financial Markets for new academic session 2025-26 CBSE and State board. All the questions are given simplified format with suitable examples and MCQ. Download class 12 B St Solutions Chapter 10 without any login or registration.

Viva Questions for Class 12 Business Studies

NCERT Solutions for Class 12 Business Studies Chapter 10

Class 12 Business Studies Chapter 10 NCERT Solutions

Very Short Answer Type Questions

What is a Treasury bill?

Treasury bill is a short term promissory note issued by the Reserve Bank of India on behalf of the Central Government of India. They are issued to fulfil the short-term fund requirements of the Government of India. Maturity period of Treasury Bills ranges from 14 days to 364 days. Generally, these bills are bought by commercial banks, LIC, UTI, non-banking financial companies, etc. They are also called Zero-Coupon Bonds. Treasury bills are highly liquid instruments because of the fact that the RBI is always ready to purchase these bills. Moreover, they are also considered to be the safest instrument as they are issued by the RBI. They are available for a minimum amount of Rs 25,000 and in multiples thereof. Treasury Bills are issued at a discount i.e. they are issued at a price which is lower than the face value and are redeemed at par. Herein, the discount (the difference between the price of issue and the redemption value) is the interest received at the time of redemption. Objective of issuing T-Bills is to fulfill the short-term money borrowing needs of the government. T-bills have an advantage over the other bills such as:

- Zero Risk weightage associated with them. They are issued by the government and sovereign papers have zero risk assigned to them.

- High liquidity because 91 days and 364 days are short term maturity.

- Transparency.

- The secondary market of T-Bills is very active so they have a higher degree of tradability.

Name the segments of the National Stock Exchange (NSE).

The National Stock Exchange is the latest, most modern and technology driven exchange. It was incorporated in 1992 and was recognized as a stock exchange in April 1993. It provides trading in two main segments:

1. Whole sale debt Market segment.

2. Capital Market segment.

State any two reasons why investing public can expect a safe and fair deal in the stock market. (Point w.r.t safety of transactions – Functions of the Stock Exchange).

Investing public can expect a safe and fair deal in the stock market due to these two main reasons:

- To protect the interest and right of investors, particularly by guiding and educating individual investors on the way to deal in stock exchange.

- To develop and regulate fair practice and code of conduct by intermediaries like brokers, merchant banker etc.

What is the common name for Beneficiary Owner Account, which is to be opened by the investors for trading in securities?

The common name for beneficiary account is ‘Demat Account’. A beneficiary owner is an owner who enjoys the benefits of ownership even though the property is titled with the name of someone else.

Name any two details that need to be provided by the investor to the broker while filling a client registration form.

The two details that need to be provided by the investor to the broker while filling a client registration form are:

- PAN number. (This is mandatory)

- Date of birth and address.

Short Answer Type Questions

What are the functions of a financial market?

A financial market refers to the market where the creation and exchange of financial assets such as shares and debentures takes place. The following are the functions of a financial market.

1. Mobilization of Savings and Channeling them into the Most Productive Uses: A financial market acts a link between the savers and the investors. It provides a platform for the transfer of savings from the households to the investors. It gives savers the choice of different investments and thus helps to channelize surplus funds into the most productive use.

2. Facilitate Price Discovery: Similar to a commodity, the price of a financial asset is established through the forces of demand and supply for funds. Financial market provides a platform for the interaction of the demand of the funds (represented by the business firms) and the supply of funds (represented by the households). Thereby, it helps in determining the price of the asset being traded.

3. Provides Liquidity to Financial Assets: An asset or a security can be easily purchased and sold in a financial market. This renders liquidity to the assets. That is, through trading in the financial market, assets can be easily converted into cash or cash equivalents.

4. Reduce the Cost of Transaction: Financial markets provide valuable information about securities being traded in the market. It helps to save time, effort and money that both buyers and sellers of a financial asset would have to otherwise spend to try and find each other. The financial market is thus, a common platform where buyers and sellers can meet for fulfillment of their individual needs.

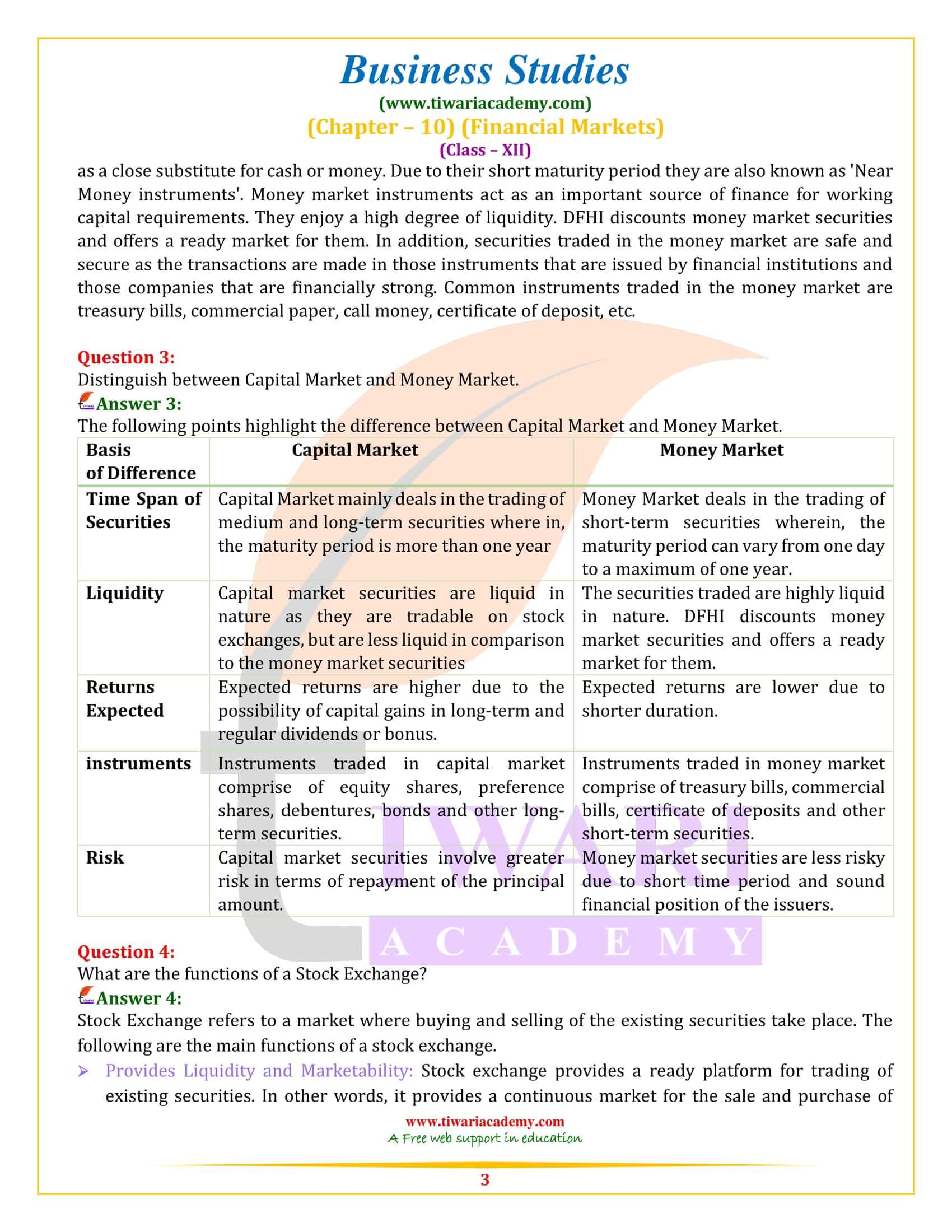

Money Market is essentially a Market for short term funds. Discuss.

Money market refers to the market for trading of short term securities and funds. Securities traded in the money market have a very short maturity period ranging from one day to one year. Such assets act as a close substitute for cash or money. Due to their short maturity period they are also known as ‘Near Money instruments’. Money market instruments act as an important source of finance for working capital requirements. They enjoy a high degree of liquidity. DFHI discounts money market securities and offers a ready market for them. In addition, securities traded in the money market are safe and secure as the transactions are made in those instruments that are issued by financial institutions and those companies that are financially strong. Common instruments traded in the money market are treasury bills, commercial paper, call money, certificate of deposit, etc.

What are the functions of a Stock Exchange?

Stock Exchange refers to a market where buying and selling of the existing securities take place. The following are the main functions of a stock exchange.

Provides Liquidity and Marketability: Stock exchange provides a ready platform for trading of existing securities. In other words, it provides a continuous market for the sale and purchase of securities. Through stock exchange, securities can be easily converted into cash whenever required. In addition, long-term securities can be converted to medium-term and short-term through stock exchange.

Determination of Prices: A stock exchange helps in establishing the price of the monetary assets that are traded in that market. It provides a platform for interaction for buyers and sellers of securities and thereby, helps in the determination of prices of the securities through the forces of demand and supply.

Fair and Safe Market: As stock exchange is a legal and well regulated market. It trades within the defined and the existing legal framework. Thereby, it ensures safety and fairness in transactions.

Facilitates Economic Growth: In a Stock Exchange the securities are continuously brought and sold. This continuous process of disinvestment and reinvestment helps in channelizing the savings and the investments to the most productive use. This enhances capital formation and economic growth.

Spreading Equity Cult: Through regulation of the issues and better trading practices, a stock exchange helps in educating the people about investment. It promotes and encourages the people to invest in ownership securities.

Acts as an Economic Barometer: Through changes in the share prices, a stock exchange indicates the changes in economic conditions. For instance, a boom (or recession) is reflected in the rise (or fall) in the share prices.

Scope for Speculation: It is generally believed that certain degree of speculation is necessary for better liquidity and to maintain demand and supply of securities. Stock exchange provides a reasonable and controlled scope of speculation within the provisions of law.

What are the objectives of the SEBI?

Securities and Exchange Board of India (SEBI) was established for promoting an orderly and healthy growth of the securities market in India. The following points highlight the overall objectives of SEBI.

- To regulate stock exchanges and the securities industry to promote their orderly functioning.

- To protect the rights and interests of investors, particularly individual investors and to guide and educate them.

- To prevent trading malpractices and achieve a balance between self-regulation by the securities industry and its statutory regulation

- To regulate and develop a code of conduct and fair practices by intermediaries like brokers, merchant bankers etc., with a view to making them competitive and professional.

State the objectives of the NSE.

National Stock Exchange of India was incorporated in the year1992. It was recognized as Stock Exchange in 1993 and started operations in 1994. It was established by leading banks, financial institutions, insurance companies and financial intermediaries. NSE was established with the following objectives:

- NSE aimed at setting up a single nationwide trading system for providing the trading facility in all types of securities. Such a system increases the confidence of the investors.

- It ensured that all the investors over the country get an easy and equal access through an appropriate communication network. It increases the liquidity of the securities. Under the system of regional stock exchange, the number of people involved in the transaction was limited. As against this, NSE incorporates transactions from investors from the entire country and thereby, increases the liquidity of the securities.

- By using an electronic trading system, NSE aims at providing a fair, and efficient and transparent securities market. Any person can get information regarding the trading of various securities from the local terminals of NSE. Thereby, it helps in reducing fraud in trading.

- One of the objectives of NSE includes enabling shorter settlement cycles and book entry settlements.

- NSE aimed at meeting the international standards and benchmarks of stock exchange.

Name the document prepared in the process of online trading of securities that is legally enforceable and helps to settle disputes/claims between the investor and the broker.

Once the trade has been executed, within 24 hours the broker issues a Contract Note. This note contains details of the number of shares bought or sold, the price, the date and time of deal, and the brokerage charges. This is an important document as it is legally enforceable and helps to settle disputes/claims between the investors and the broker. A unique Order Code number is assigned to each transaction by the stock exchange and is printed on the contract note.

Long Answer Type Questions

Explain the various Money Market Instruments.

Money Market refers to the market where short term funds are traded. Herein, short term funds are in the form of monetary assets having a maturity period of maximum one year. The following are some of the common money market instruments.

Treasury bill (T-Bills): Treasury bill refers to a promissory note used for short term borrowing by the government. They are the most commonly used money market instrument. They are auctioned and issued by the Reserve Bank of India on behalf of the Central Government. T-bills are available for a minimum of Rs 25,000 and in multiples thereof. T- Bills are issued at a price lower than their face value and at the time of redemption, the investor gets the amount equal to the face value. The difference between the value at which they are issued and the redemption value is the interest received on them. For example, if an investor purchases a 182-days treasury bill with a face value of Rs 56,000 for Rs 50,000. At the time of maturity, the investor will receive Rs 56,000. Thus, the difference of Rs 6,000 (56,000 – 50,000) is the interest receivable on the bill. T-Bills are also called Zero-coupon Bonds. T-bills are highly liquid bonds and have assured yield and negligible risk of default.

Call Money: Call money is short term finance repayable on demand, with a maturity period of one day to fifteen days, used for inter-bank transactions. Commercial banks have to maintain a minimum cash balance known as cash reserve ratio. The Reserve Bank of India changes the cash reserve ratio from time to time which in turn affects the amount of funds available to be given as loans by commercial banks. Call money is a method by which banks borrow from each other to be able to maintain cash reserve ratio. The interest rate paid on call money loans is known as the call rate. It is a highly volatile rate that varies from day-to-day and sometimes even from hour to-hour. There is an inverse relationship between call rates and other short-term money market instruments such as certificates of deposit and commercial paper. That is, as the call rate rise, other instruments of money market become cheaper and their demand increases.

Commercial Paper (CPs): Commercial paper is an unsecured short-term money market instrument. It is a negotiable and transferable promissory note with a maturity period ranging from a minimum of 15-days to a maximum of one year. They were introduced in India in 1990. CPs are mainly issued by large and creditworthy companies to raise short-term funds. Large companies view Commercial Papers as an alternative to bank borrowings and borrowings through capital market. The rate of interest payable on Commercial Papers is lower than the market rates. Generally, companies use Commercial Papers for bridge financing. That is, to raise the funds required to meet the floatation cost incurred on long term borrowings in the capital market. For example, if a company wishes to raise finance from the capital market to purchase land. For this, it will have to incur floatation cost such as cost related to brokerage, commission, advertising, etc. To finance such floatation costs the company can issue Commercial Paper.

Certificate of Deposit (CDs): Certificate of Deposits are time deposits which are negotiable and unsecured in nature. They are bearer instruments for a short and specified time period ranging from one month to more than five years. CDs are a secured form of investment, which are issued to individuals, corporations and companies by the commercial banks and development financial institutions. They are issued to meet the demand for credit in times of tight liquidity position. For example, when a person buys a CD by depositing a specific amount, he receives a certificate wherein the term of deposit, the interest rate applicable and the date of maturity is written. On the date of maturity, the individual gets entitled to receive the principle amount and the earned interest on it.

Commercial Bill: Commercial bill also known as bill of exchange refers to the instrument used to finance the working capital requirements of a firm. It is a short term negotiable instrument. Companies use Commercial Bills to finance their credit sales. For example, when an individual makes credit sales, the buyer becomes liable to make the payment on a specified future date. Herein, the seller draws a bill of exchange and gives it to the buyer mentioning a specific maturity period. Once the bill is accepted by the buyer it becomes a marketable instrument which can be discounted with a bank.

Explain the objectives and functions of the SEBI.

The Securities and Exchange Board of India was established in 1988 in order to encourage an orderly and healthy growth of the securities market. SEBI was set with an overall objective of investor protection and to promote the development and regulation of the functions of the securities market.

Objectives of SEBI: The overall objective of SEBI is to protect the interests of investors and to promote the development of, and regulate the securities market. This may be elaborated as follows:

- To regulate stock exchanges and the securities industry to promote their orderly functioning.

- To protect the rights and interests of investors, particularly individual investors and to guide and educate them.

- To prevent trading malpractices and achieve a balance between self-regulation by the securities industry and its statutory regulation.

- To regulate and develop a code of conduct and fair practices by intermediaries like brokers, merchant bankers etc., with a view to making them competitive and professional.

Functions of SEBI:

Keeping in mind the emerging nature of the securities market in India, SEBI was entrusted with the twin task of both regulation and development of the securities market. Regulatory Functions:

- Registration of brokers and sub brokers and other players in the market.

- Registration of collective investment schemes and Mutual Funds.

- Regulation of Stock Bankers and portfolio exchanges, and merchant bankers.

- Prohibition of fraudulent and unfair trade practices.

- Controlling insider trading and takeover bids and imposing penalties for such practices.

- Calling for information by undertaking inspection, conducting inquiries and audits of stock exchanges and intermediaries.

- Levying fee or other charges for carrying out the purposes of the Act.

- Performing and exercising such power under Securities Contracts (Regulation) Act 1956, as may be delegated by the Government of India.

Development Functions:

- Investor education

- Training of intermediaries

- Promotion of fair practices and code of conduct of all SRO’s.

- Conducting research and publishing information useful to all market participants

FAQs

What is a financial Market as per class 12 Business Studies Chapter 10?

Honestly speaking any deal of money or funds is a financial market.

How can we score well in Class 12 Business Studies chapter 10?

Read the chapter carefully from the textbook and develop the habit of reading the daily newspaper – particularly the columns relating to economics and finance.

Can we try our luck at stock market by studying chapter 10 of 12th B. St.?

No. This topic provides an elementary knowledge of financial markets – nothing more.

Can chapter 10 of 12th Business Studies be selected for project work on business studies?

Yes. Your teachers may ask you to prepare a project work on stock exchanges.