NCERT Solutions for Class 12 Accountancy Part 2 Chapter 6 Cash Flow Statement. Download here the answers of chapter end exercises short and long questions and study material in PDF file format free. All the contents are updated for academic year 2025-26 based on latest CBSE curriculum. Important terms related to chapter 6 of class 12 accounts part 2 are also given to clear the concepts about these points. There is no login or registration required to access the contents on Tiwari Academy website.

Class 12 Accountancy Part 2 Chapter 6 Question Answers

Class 12 Accountancy Part 2 Chapter 6 Cash Flow Statement

| Class: 12 | Accountancy (Part 2) |

| Chapter: 6 | Cash Flow Statement |

| Contents: | Study Material and NCERT Solutions |

Cash flow statement

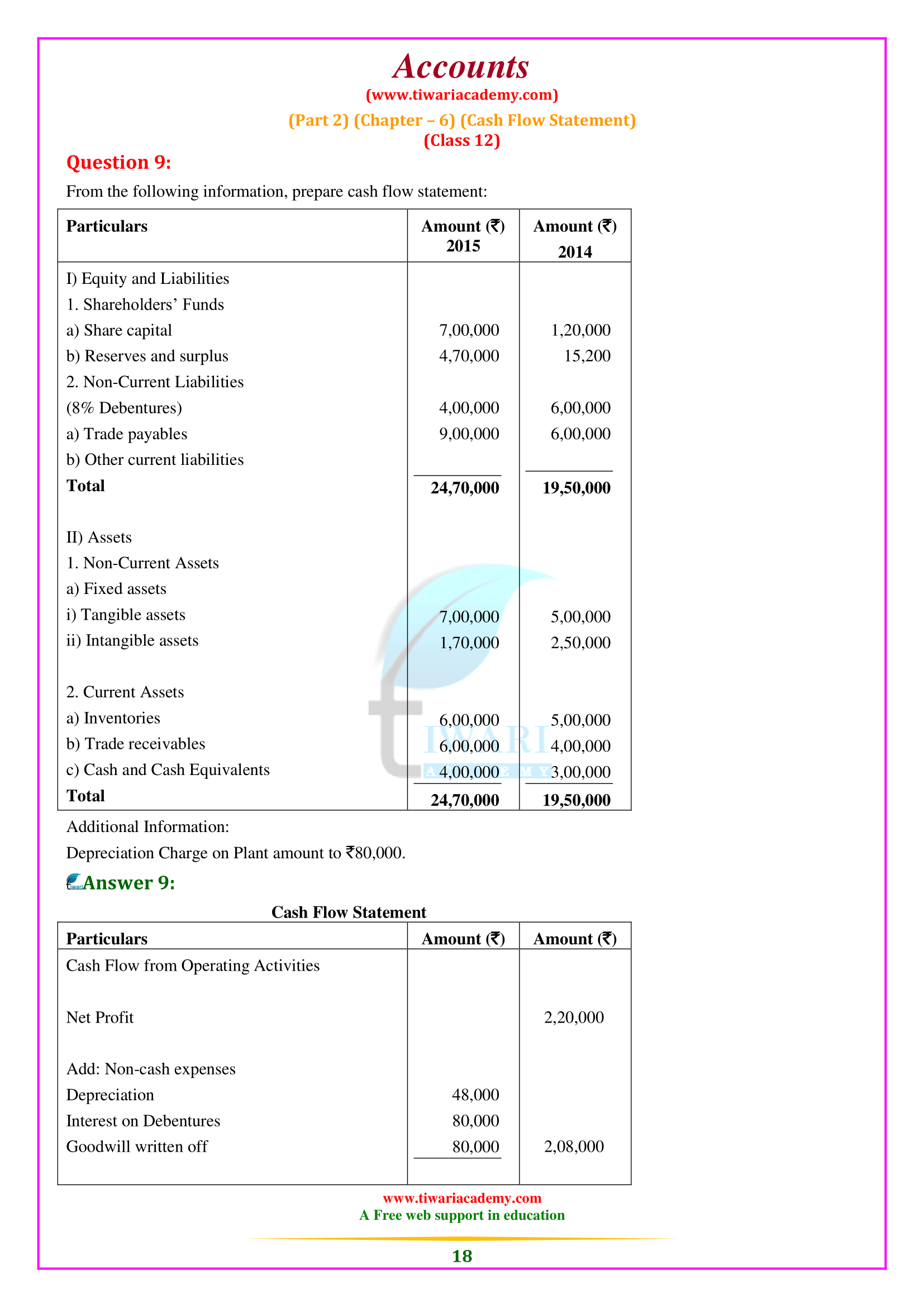

A cash flow statement provides information about historical changes by classifying cash flows in the operations, investments, and financing activities of a company’s cash and cash equivalents. This requires that a company must prepare a statement of cash flows, and present it for each accounting period for which the financial statements are presented. Here, we will discuss the technique and explains the method of preparing a statement of cash flows for the accounting period.

Benefits of Cash Flow Statement

- A statement of cash flows when used in combination with other financial statements, provides information that gives users the net assets of a company, its financial structure (including its liquidity and solvency) and its impact Enables to evaluate the potential of Cash volume and time to adapt the changing circumstances and opportunities.

- Cash flow information is useful for evaluating a company’s ability to generate cash and cash equivalents and allows users to develop models to evaluate and compare the present value of future cash flows of different companies is.

- It also improves the comparison of information about the operational performance of different companies because it eliminates the effects of using different accounting remedies for the same transactions and events.

- It also helps in balancing your cash flow and outflow by being responsive to changing circumstances. It is also useful for verifying the accuracy of past estimates of future cash flows and examining the relationship between profitability and net cash flow and the effect of changing prices.

Goals of Cash Flow Statement

A cash flow statement shows the flow of cash and cash equivalents from various activities of a business during a specified period. The main purpose of a cash flow statement is to provide useful information about a company’s cash flows (inflows and outflows) during various periods, namely, operating activities, investment activities, and financial activities during a particular period. This information is useful in providing users with financial statements a basis for evaluating a company’s ability to generate cash and cash equivalents, and the company needs to use those cash flows.

Cash and Cash Equivalents

The cash flow statement shows the flow of cash and cash equivalents from various activities of a company during a particular period. Cash includes cash on hand and deposits with banks, and ‘cash equivalent’ means highly liquid short-term investments that are easily converted into known amounts of cash and that are of negligible risk. Are subject to. Of changes. in value. An investment typically qualifies as a cash equivalent, when it has a maturity period of three months or less from the date of acquisition. Investments in shares are not counted from cash equivalents unless they are sufficient cash equivalents.

For example, a company’s preferred shares are acquired shortly before the date of its specific redemption, provided there is a negligible risk that the company will not return the amount at maturity. Similarly, short-term marketable securities that can be easily converted into cash are treated as cash equivalents and are immediately liquidated without significant changes in value.