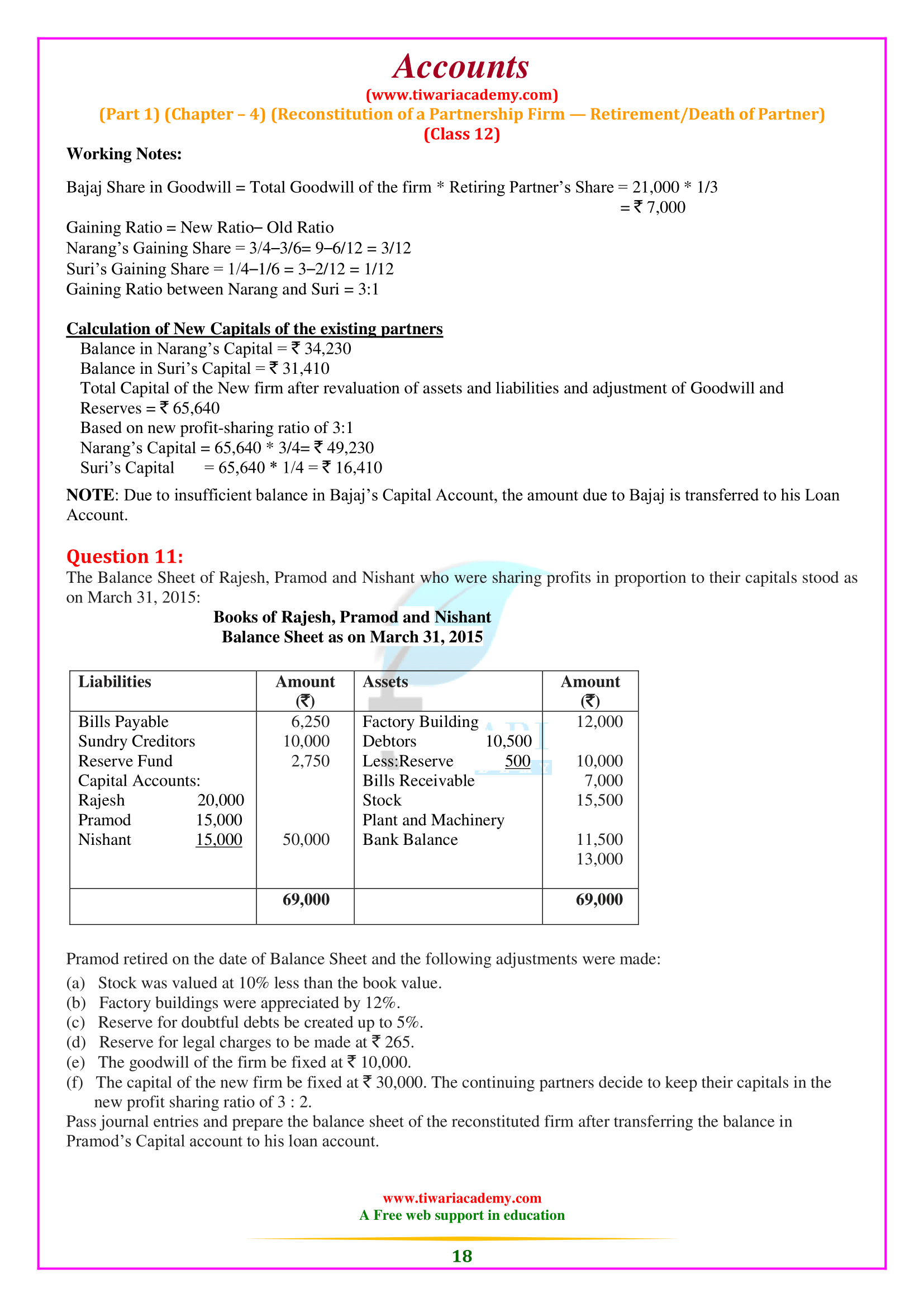

NCERT Solutions for Class 12 Accountancy Chapter 4 (Part 1) Reconstitution of a Partnership Firm-Admission of a Partner. Practice here all the question answers of NCERT Textbooks and get the notes based on 12th accounts chapter 4 with extra question answers. Important questions in the format of short and long questions with answers are given here for the preparation of CBSE exams 2025-26.

Class 12 Accountancy Chapter 4 Question Answers

NCERT Solutions for Class 12 Accountancy Chapter 4 Admission of a Partner

| Class: 12 | Accountancy (Part 1) |

| Chapter: 4 | Reconstitution of a Partnership Firm-Admission of a Partner |

| Contents: | NCERT Solutions and Extra Questions |

New Profit Sharing Ratio

The new profit sharing ratio is the ratio in which the remaining partners will share in future profits after a partner’s retirement or death. The new share of each of the remaining partners will consist of its share in the company and the acquired part of the retired/deceased partner. Generally, continuing partners acquire the share of retired or deceased partners in the old profit-sharing index.

It is unnecessary to calculate the new profit-sharing ratio between them, as it will be the same as the previous ratio profit-sharing between them. In fact, in the absence of information on the profit-sharing ratio in which the remaining partner acquires the retired / deceased partner’s stake, it is assumed that they will receive it in the above profit-sharing ratio. Hence, they will be in their past ratio in the future.

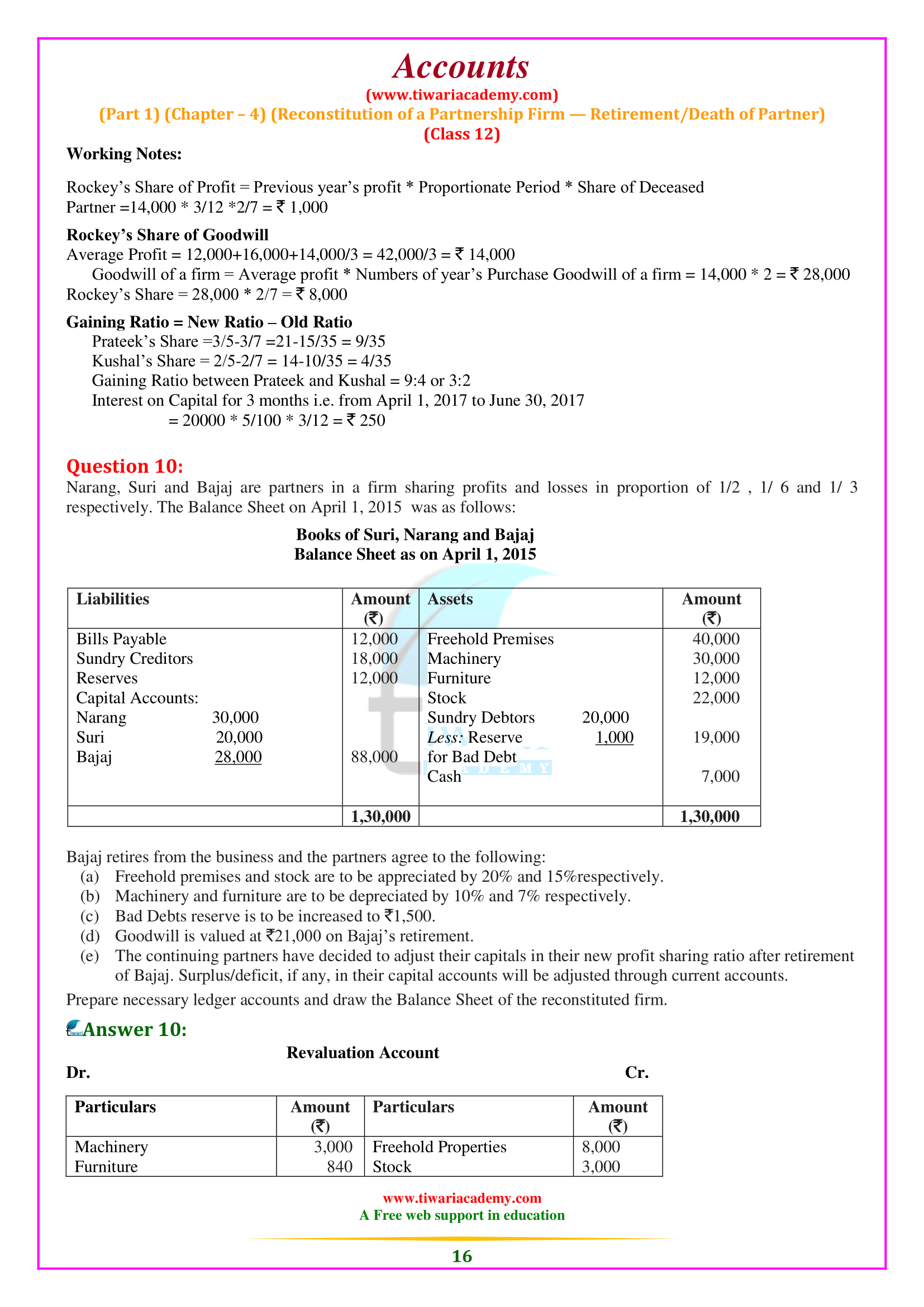

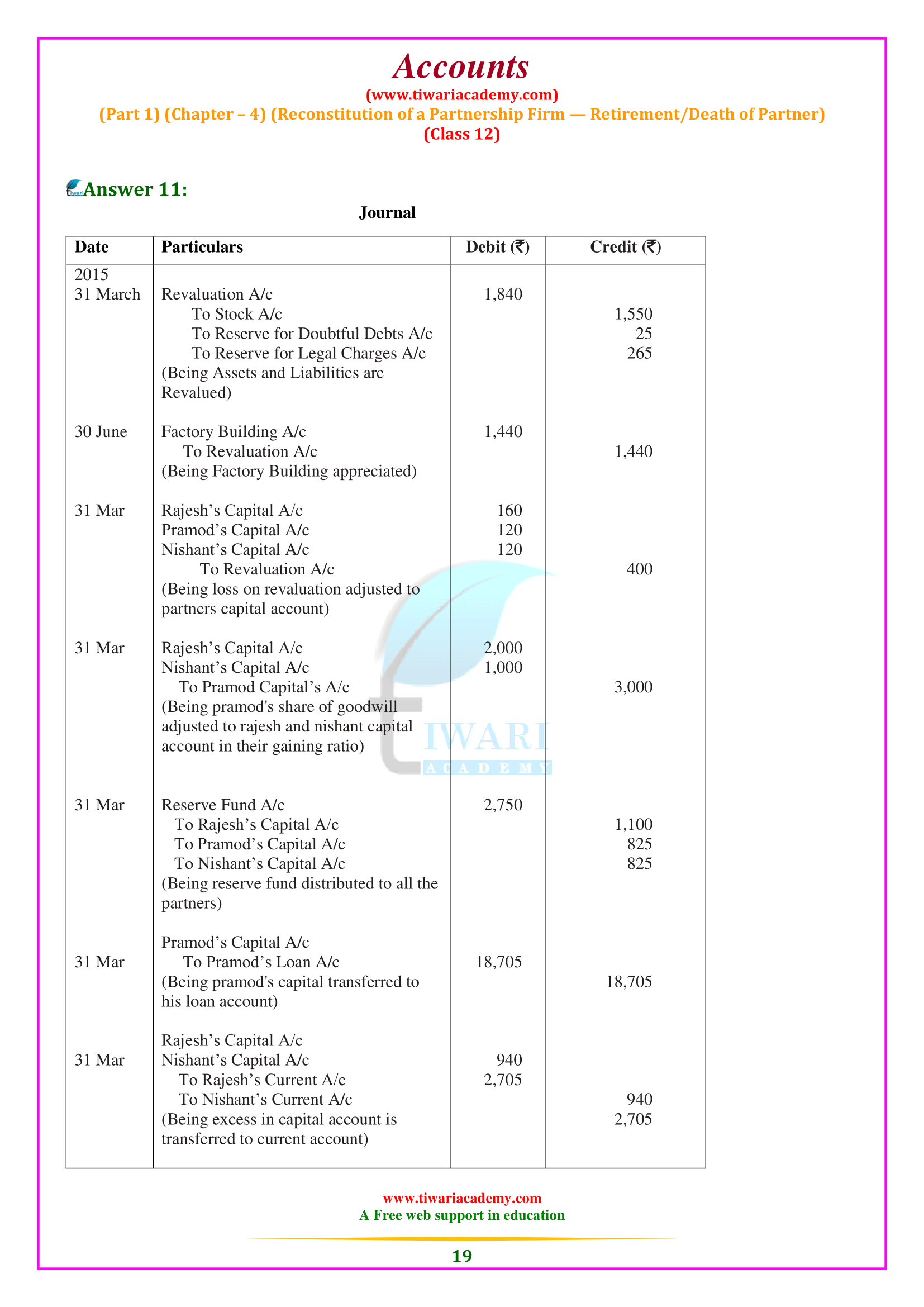

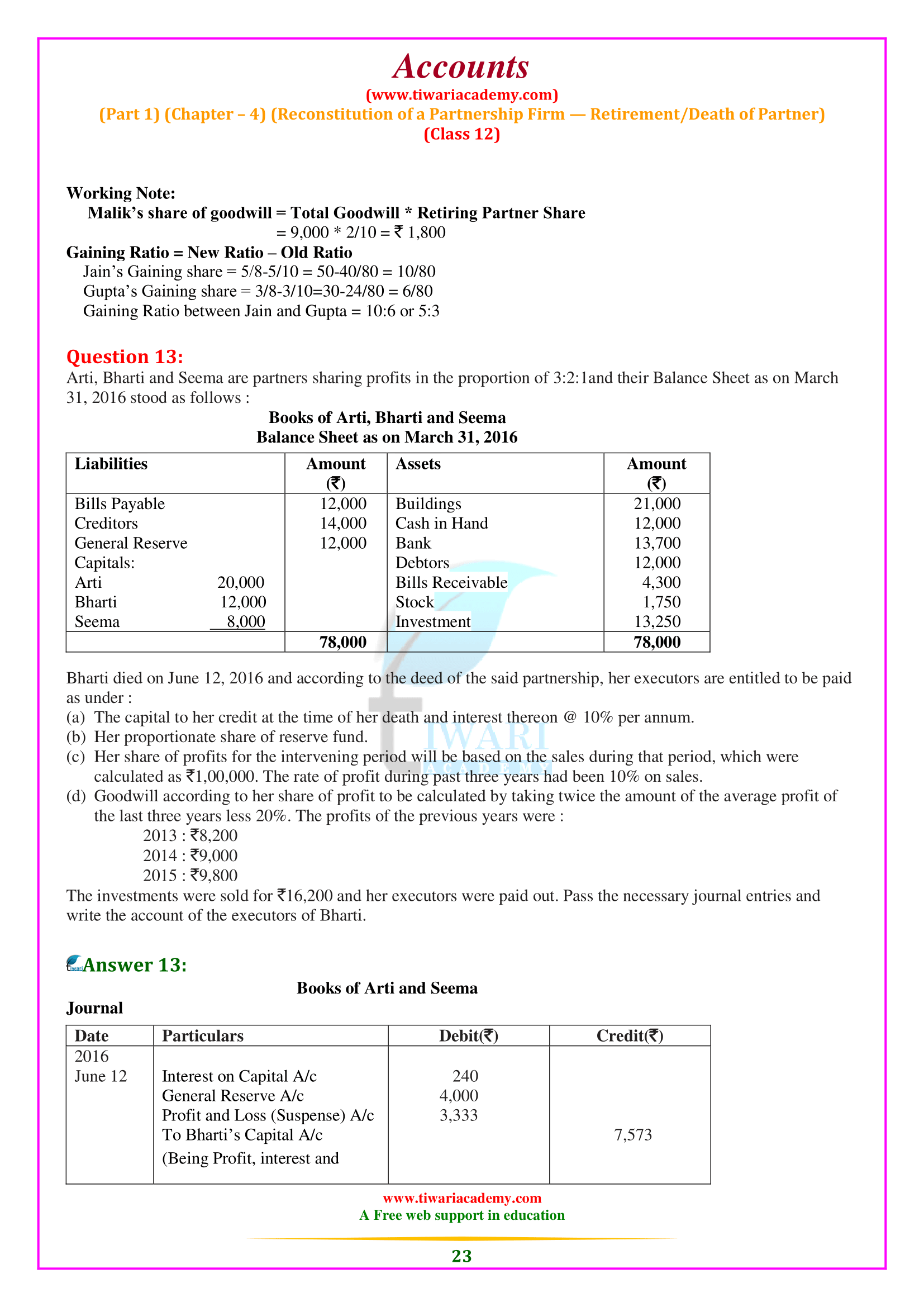

Gaining Ratio

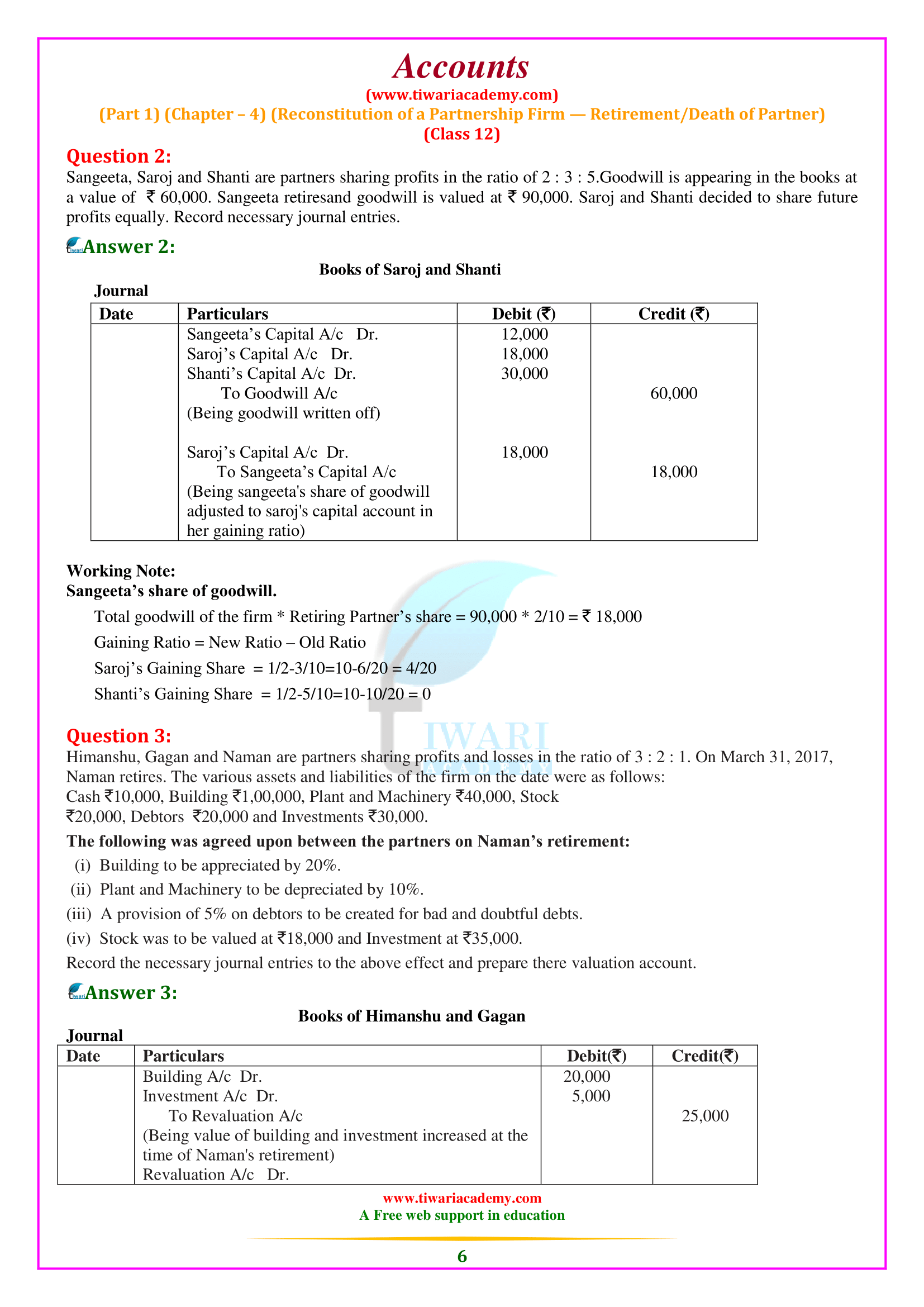

The ratio in which successive partners have acquired the share of retired / deceased partner is called the profit ratio. Typically, the continuing partner acquires the retired / deceased partner’s share in their old profit sharing ratio. In that case, the remaining partners’ profit ratio will be the same as the previous profit sharing ratio between them, and it is not necessary to calculate the benefit ratio. Alternatively, the ratio in which they acquire the share of the retired/deceased partner.

It can be appropriately spaced. In that case, again, there is no need to calculate the rate of benefit, as this will be the rate at which they have acquired a share of the profit of the deceased partner who is retiring. The problem of calculating the profit ratio mainly arises when the new profit-sharing ratio of continuous partners is specified. In such a situation, the profit ratio should be calculated by subtracting each new partner’s former portion from its new share.

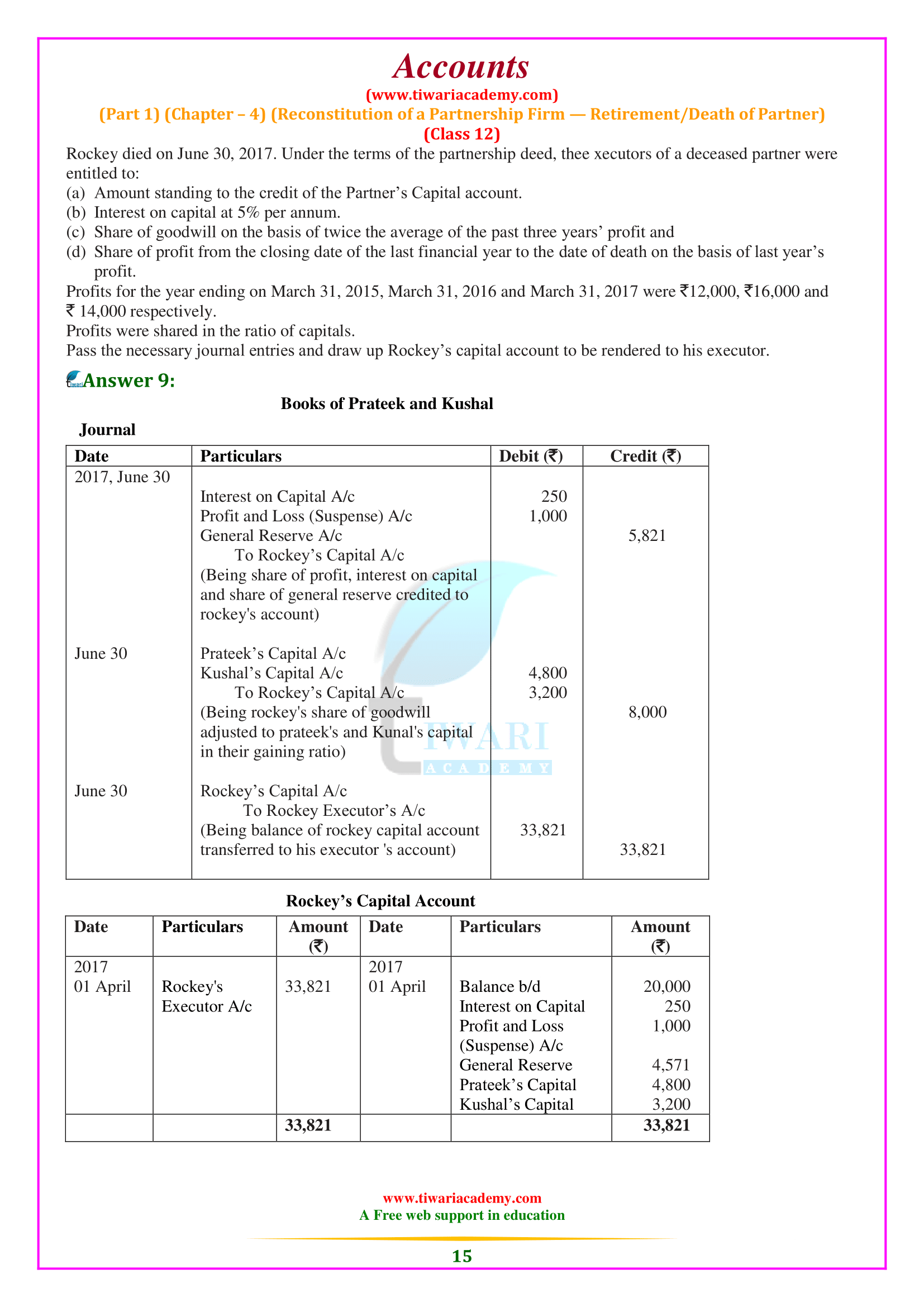

Treatment of Goodwill

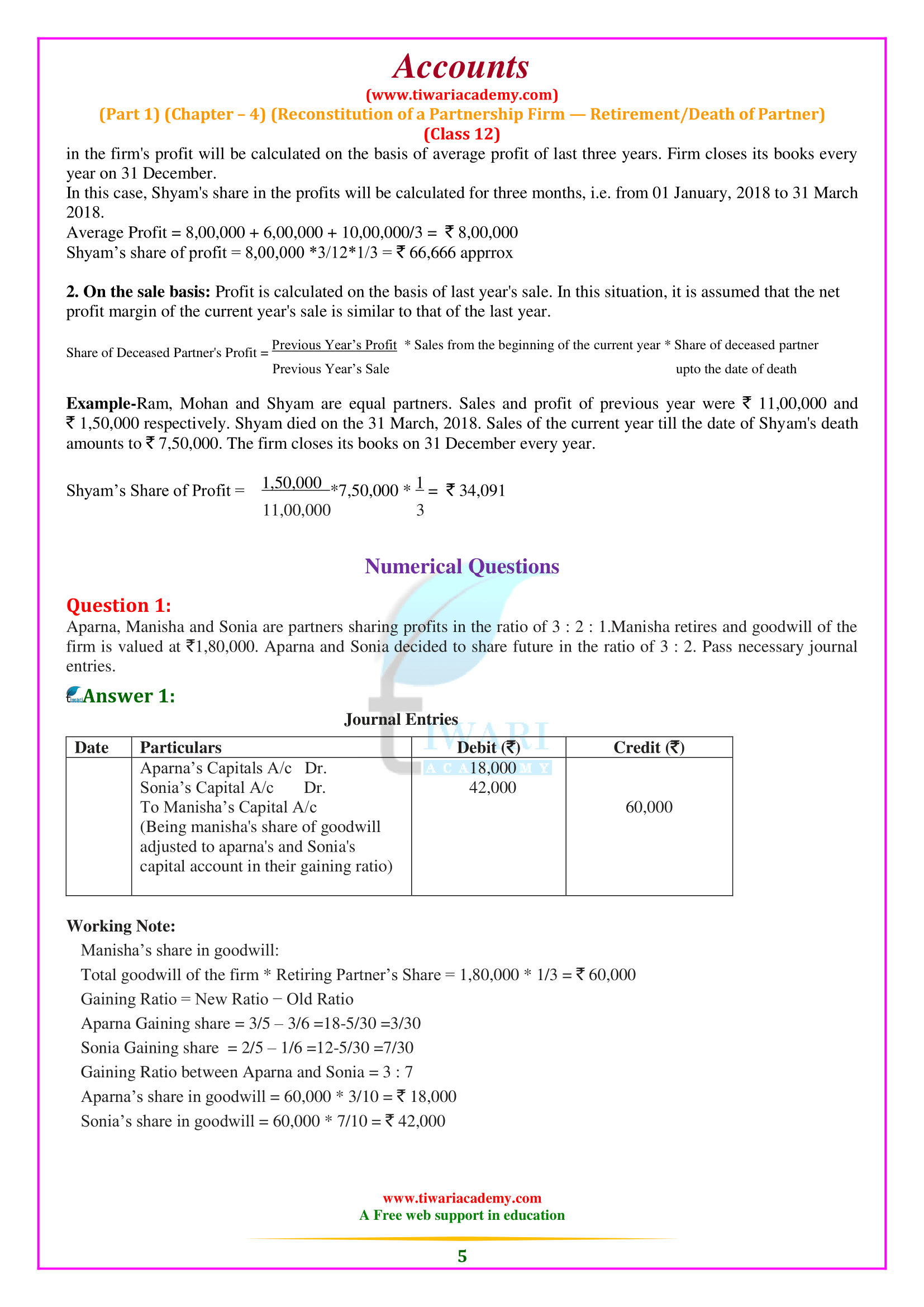

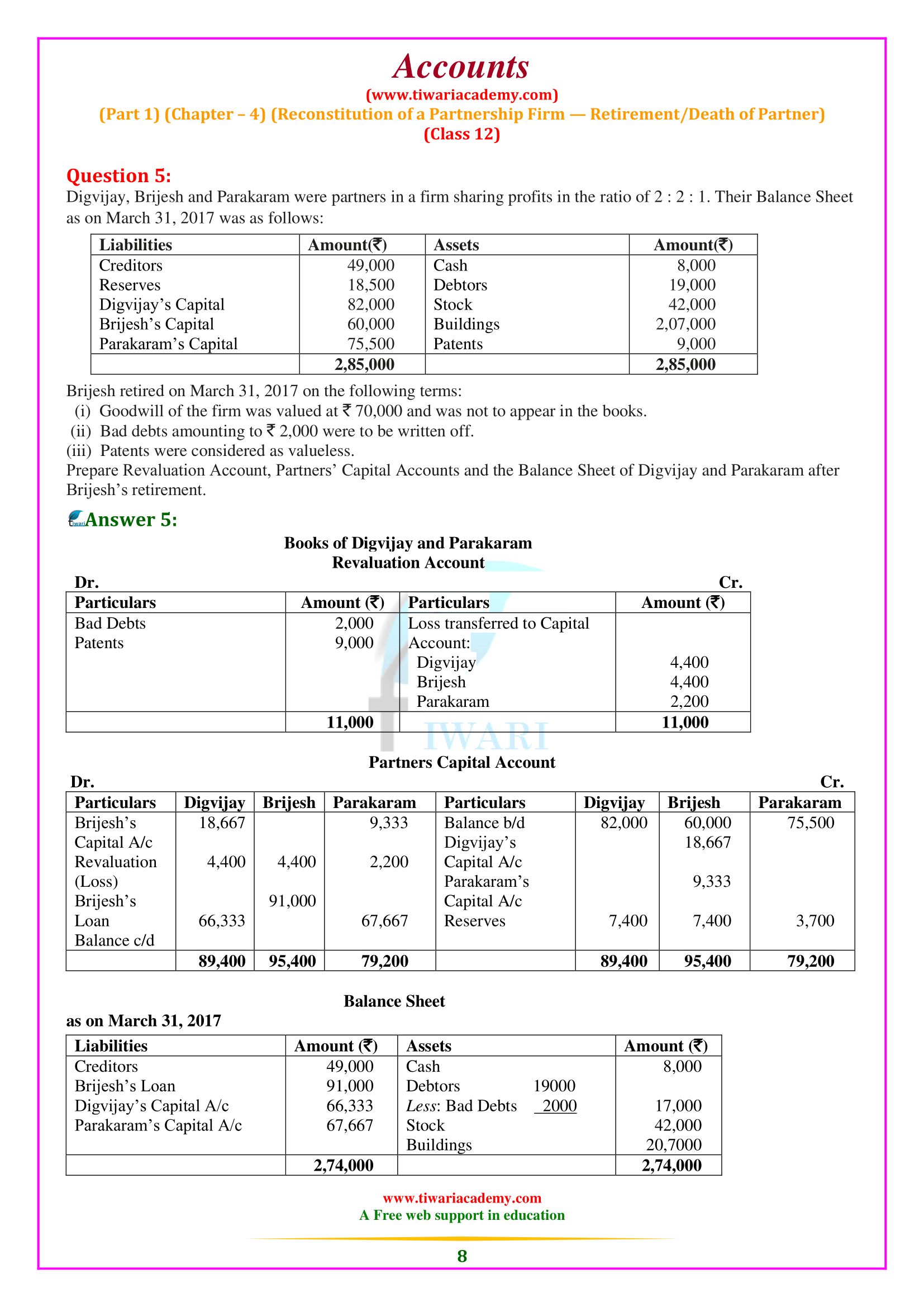

The retired or death of partner is entitled to his/her share of goodwill at the time of retirement/death, as the firm has earned goodwill through all existing partners’ efforts. Therefore, at the time of retirement/death of the partner, goodwill is valued as per the agreement between the partners. The retired/death of partner compensated for his/her share of goodwill by the continuing partners (who in their benefit ratio to the retired/deceased couple profit is earned due to the acquisition of shares. In such a situation, goodwill’s accounting treatment depends on whether the goodwill already appears on the company’s books.

Hidden Goodwill

If the company has made a lump sum payment to the account of the deceased or retired partner, in addition to the balance owed by him, the balance has been paid to his capital account after making the necessary adjustments. With accumulated gains and losses and revaluation of assets and liabilities, this will be considered part of your goodwill (known as hidden goodwill).

Why do firm revaluate assets and reassess their liabilities on retirement or on the event of death of a partner in class 12 Accounts Chapter 4?

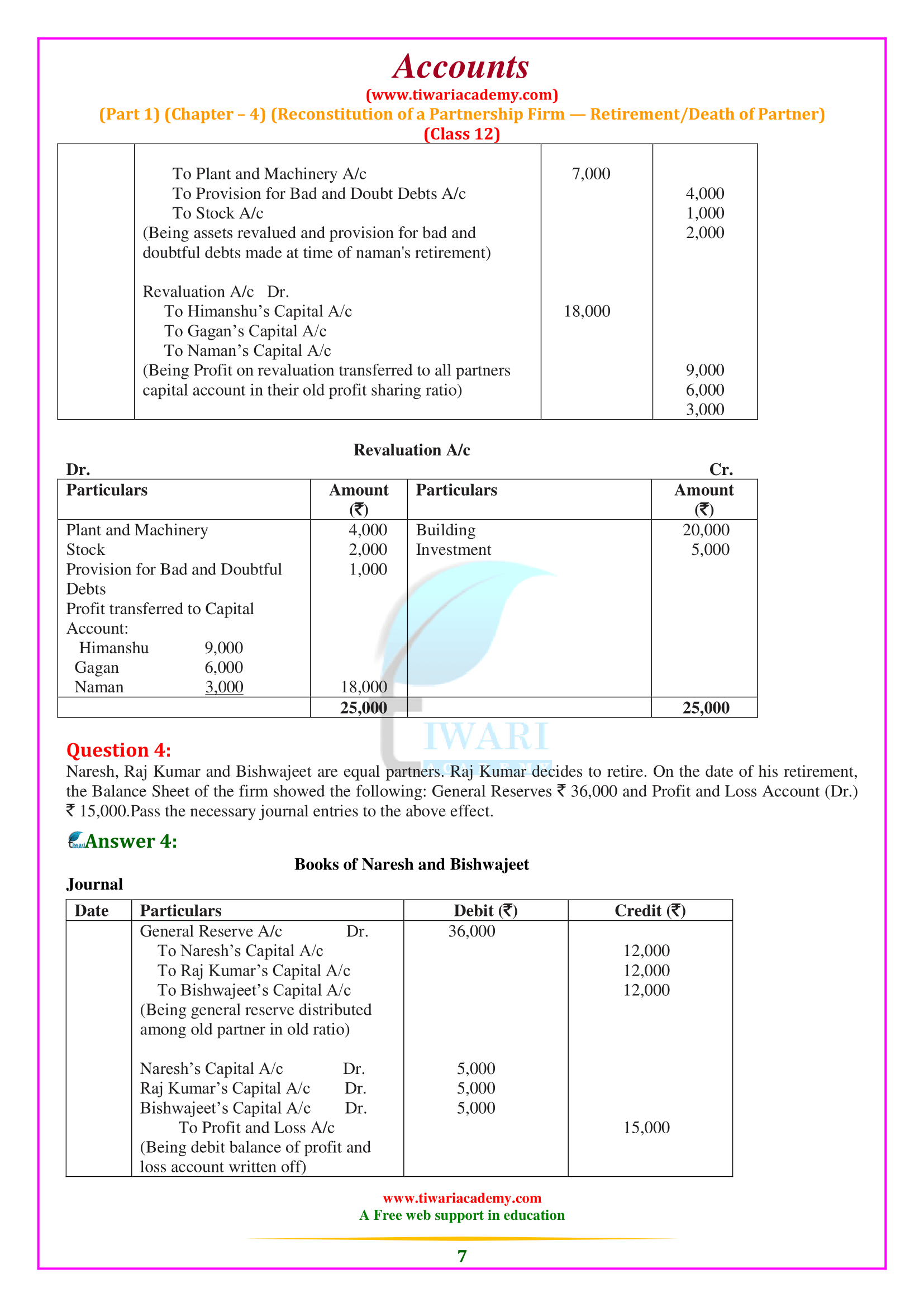

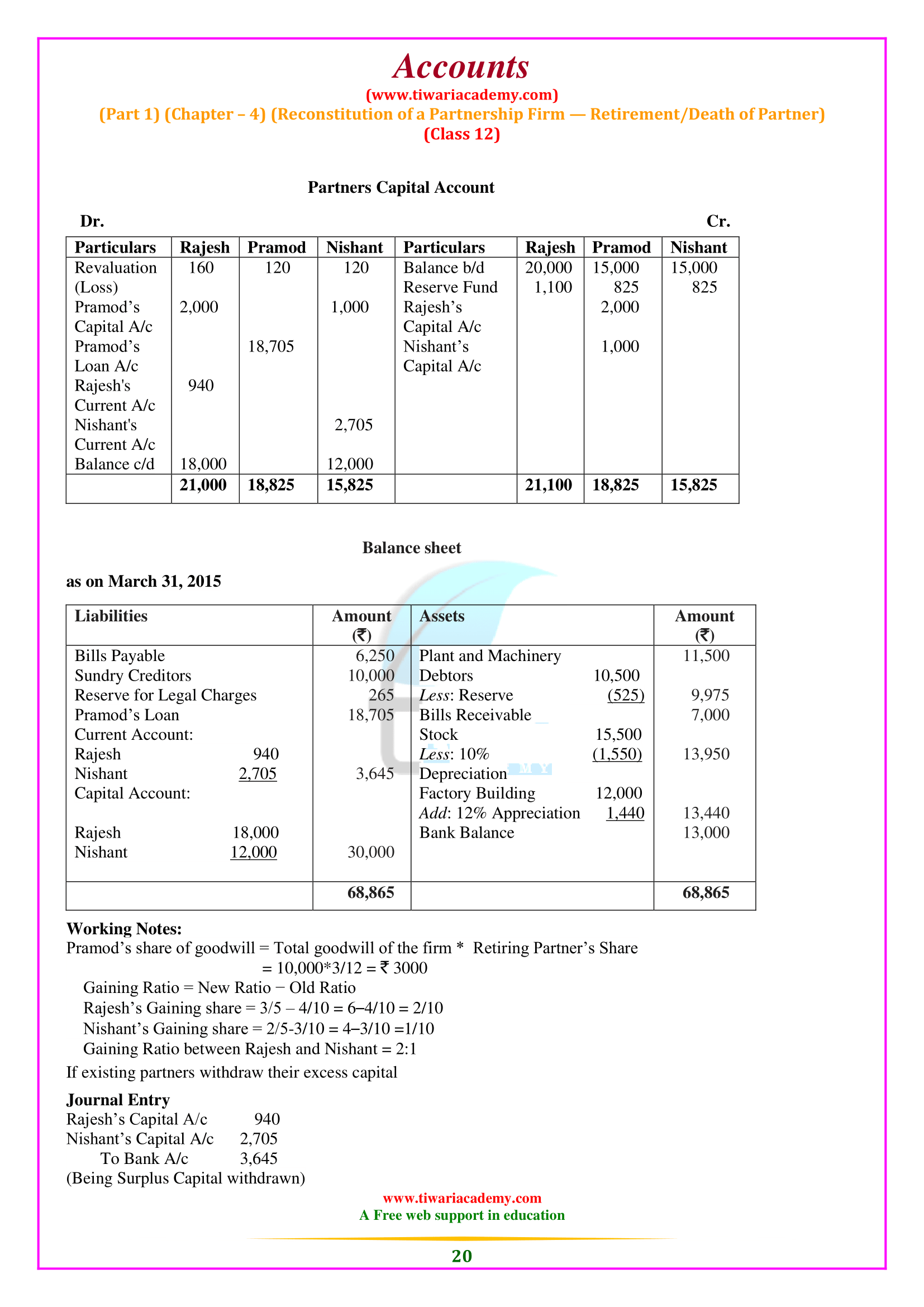

At the time of retirement or death of a partner, it is certain to revalue the assets and liabilities of the firm in order to determine their true and fair values. The revaluation is essential as the value of assets and liabilities may increase/decrease with the passage of time. Moreover, it may be possible that there are certain assets and liabilities that remained unrecorded in the books of accounts. The retiring or the deceased partner may be benefited or may bear loss due to change in the values of assets and liabilities. Therefore, the revaluation of the assets and liabilities is necessary in order to determine the true profit or loss that is to be divided among all the partners in their old profit sharing ratio

Goodwill is an intangible asset which is earned by the efforts of all the partners in the firm. The fruits of past performance and reputation is to be shared only by the remaining partners after the retirement or death of a partner and therefore, the remaining partners should compensate the retiring/deceased partner by entitling him/her a share of firm’s goodwill.

What is accumulated Profits or Losses in Class 12 Accountancy Chapter 4 Part 1?

Reservations (accumulated gains) or losses belong to all partners and must be transferred to the capital account of all partners. This is known as accumulated Profits or losses.

What is Gaining Ratio according to Class 12 Accountancy Chapter 4 of Part I?

The gaining ratio is the rate at which successive partners have acquired the share of the deceased partner who is retiring.