NCERT Solutions for Class 1 Maths Joyful Chapter 12 How Much Can We Spend? (Money) in Hindi and English Medium revised and updated according to NEP 2020. All the explanation and question-answers of class 1 Joyful Maths chapter 12 are prepared for academic session 2025-26.

Study Plan for Class 1 Mathematics

Class 1 Maths Joyful Chapter 12 How Much Can We Spend?

Class 1 Maths Chatper 12 How Much Can We Spend? (Money)

Chapter 12, “How Much Can We Spend?” from the Class 1 Maths Textbook “Joyful Mathematics”, is designed to introduce young learners to the basic concepts of money, spending, and savings in a fun and engaging way. This chapter serves as an introductory platform for children to understand the value of money and how it is used in everyday transactions. Through a series of creatively crafted activities, stories and exercises, the chapter aims to build a foundational understanding of financial literacy at an early age.

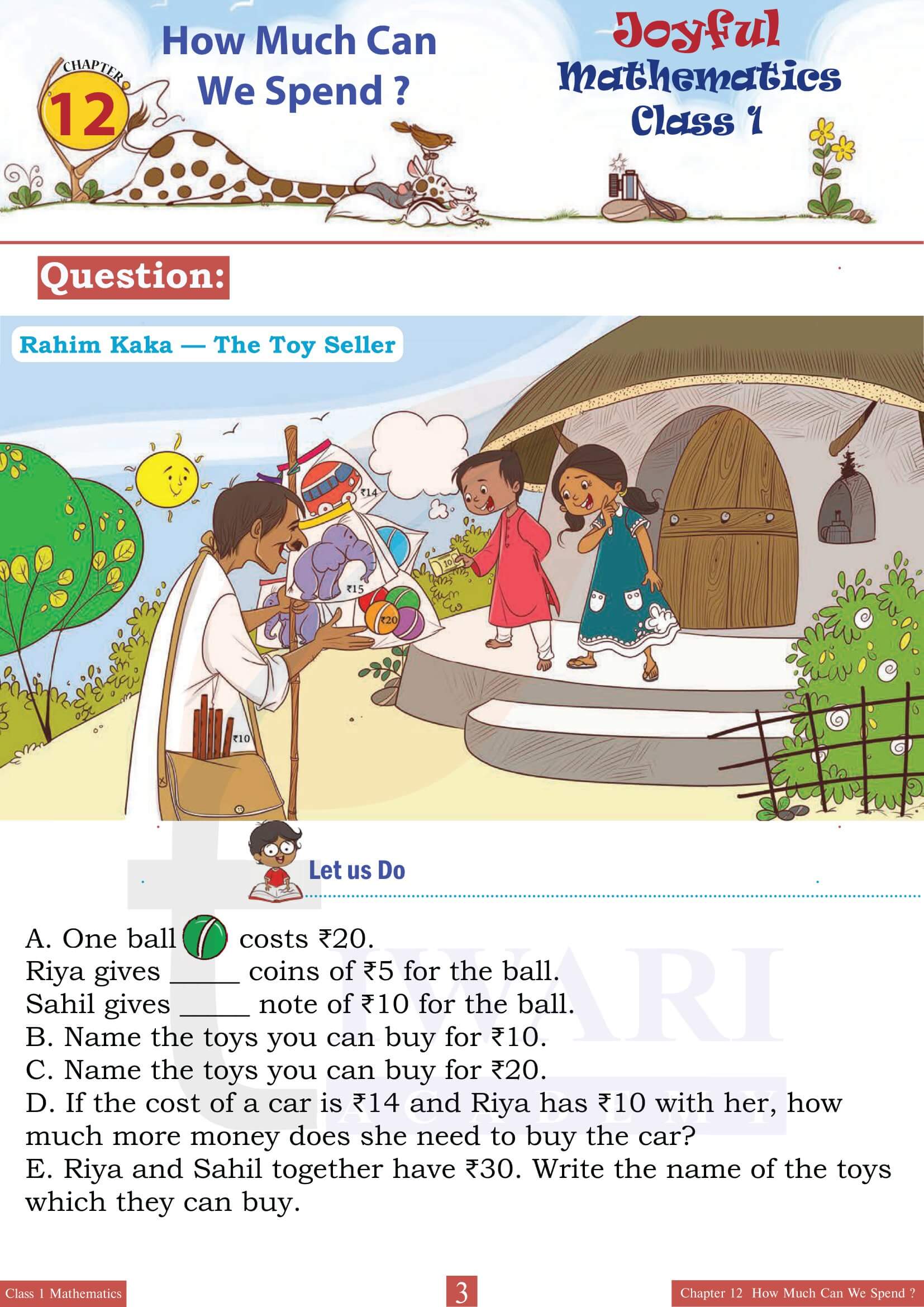

Class 1 Maths Joyful Chapter 12 of class 1 mathematics, begins by introducing the concept of money through familiar scenarios that children might encounter in their daily lives, such as buying candies, toys or books. It uses colorful illustrations and simple language to catch the interest of young minds and to make abstract concepts more tangible. The illustrations often depict children engaging in activities like shopping with their parents, saving money in piggy banks or making decisions about what to buy with a limited amount of money. These scenarios are not only relatable but also serve as practical examples of how money is used.

The Key Objectives of Chapter 12 in Class 1 Maths

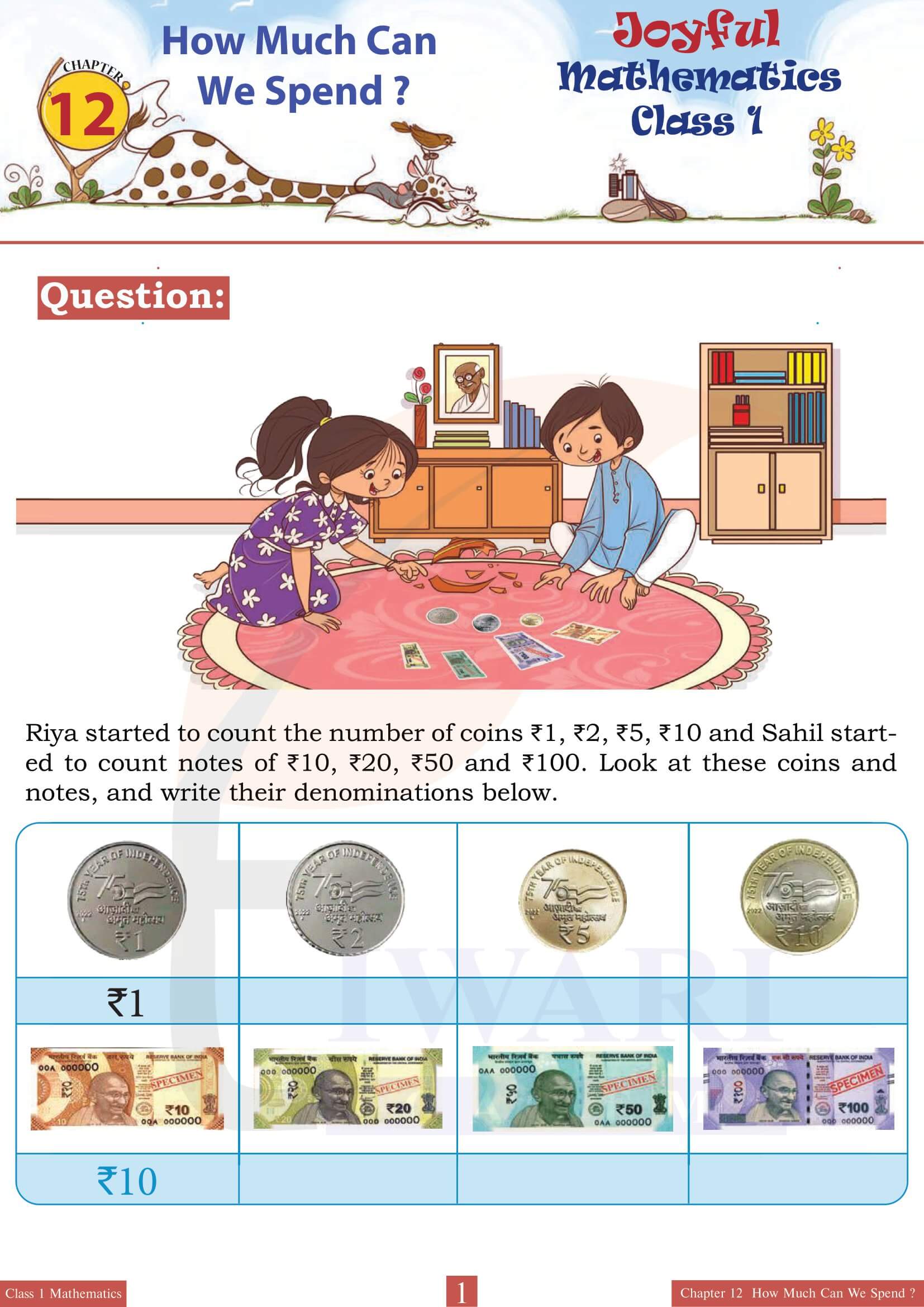

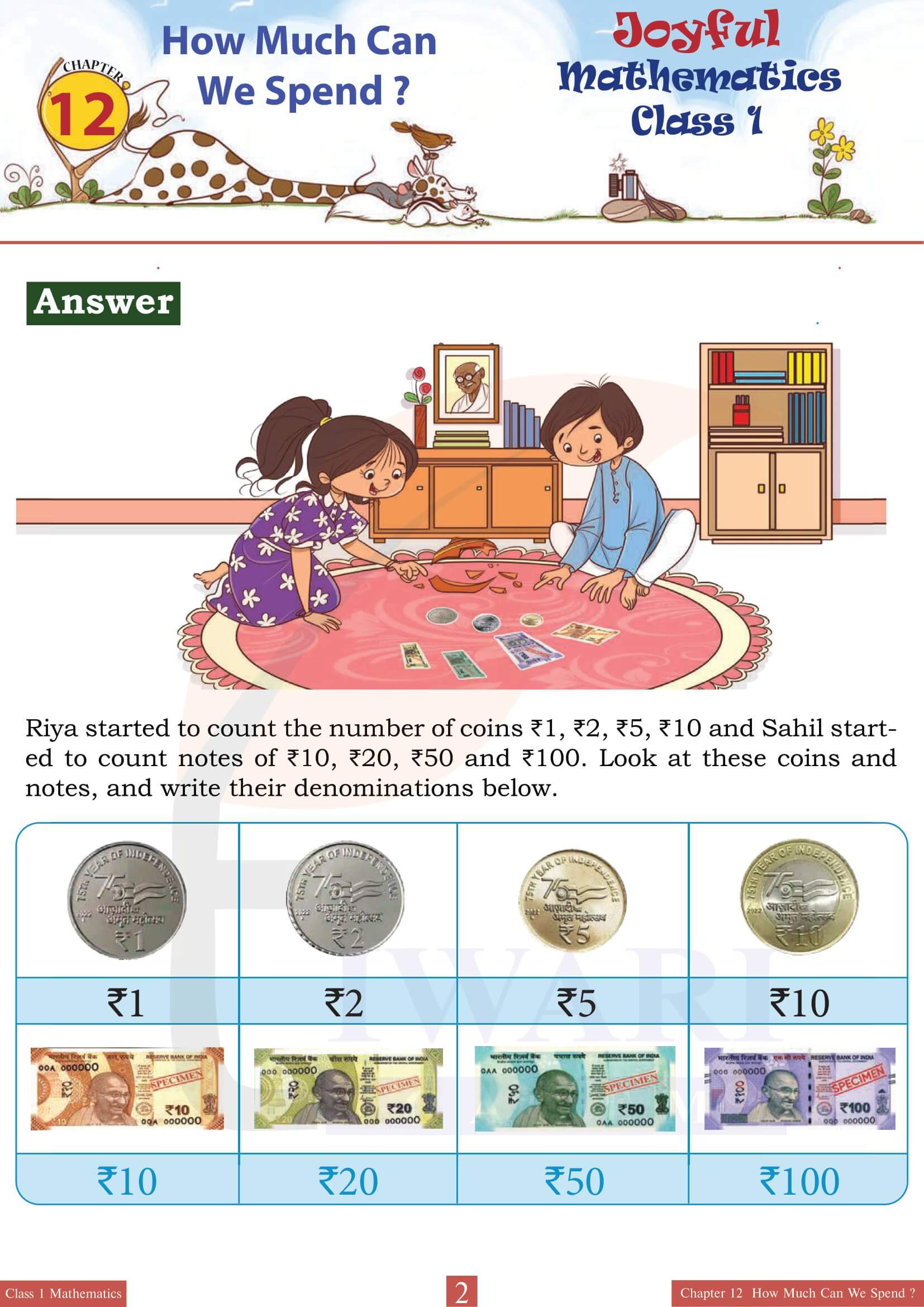

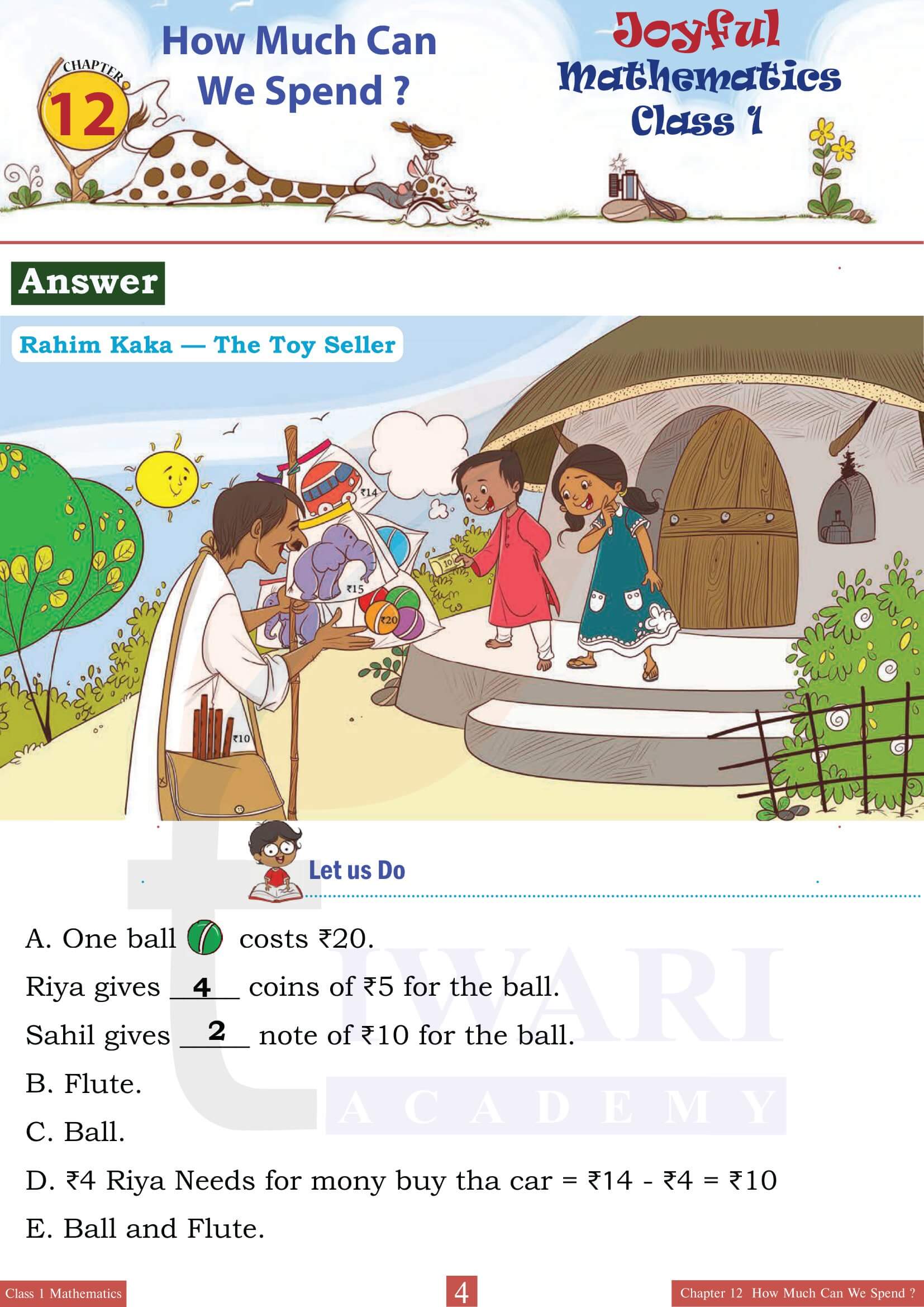

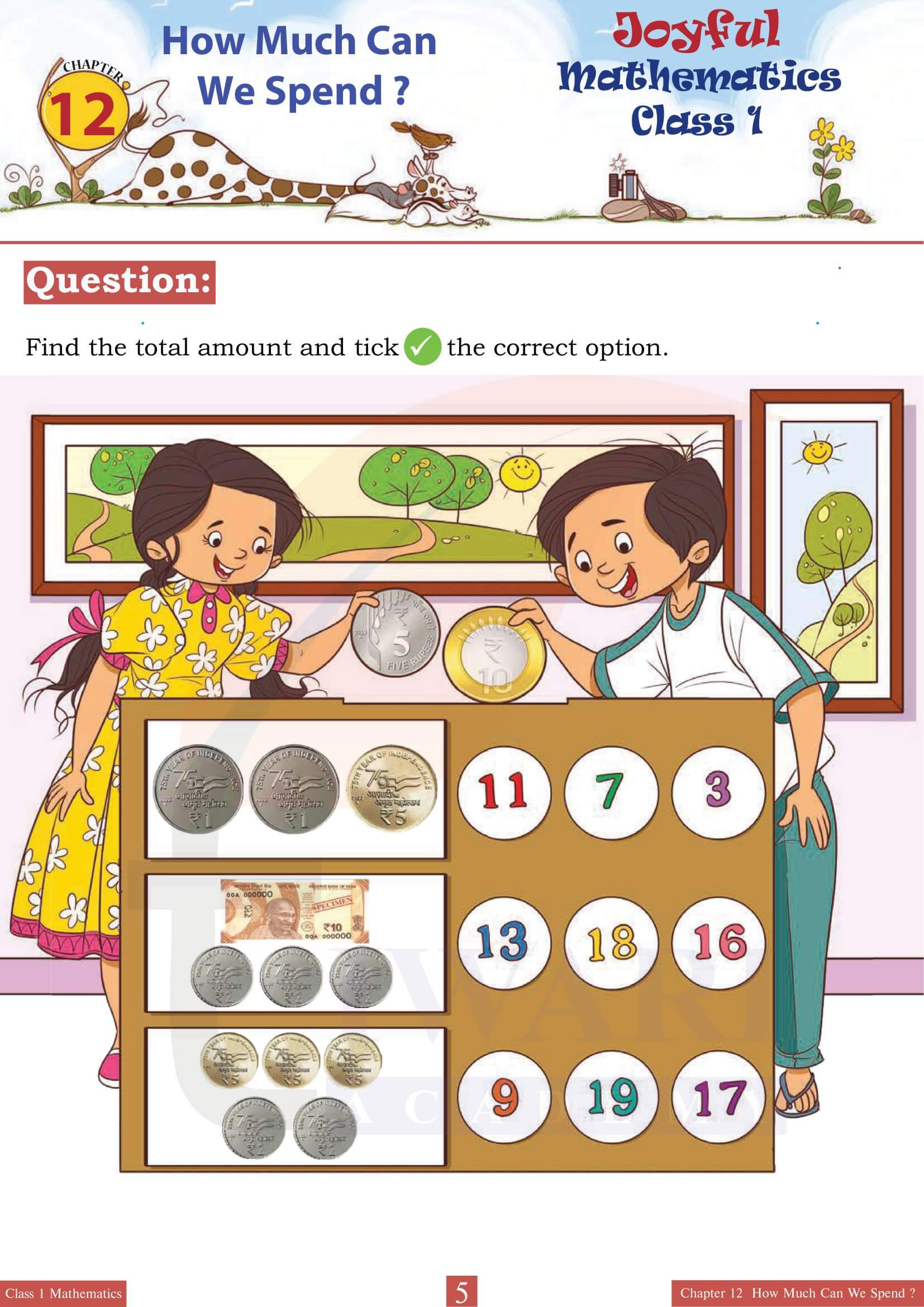

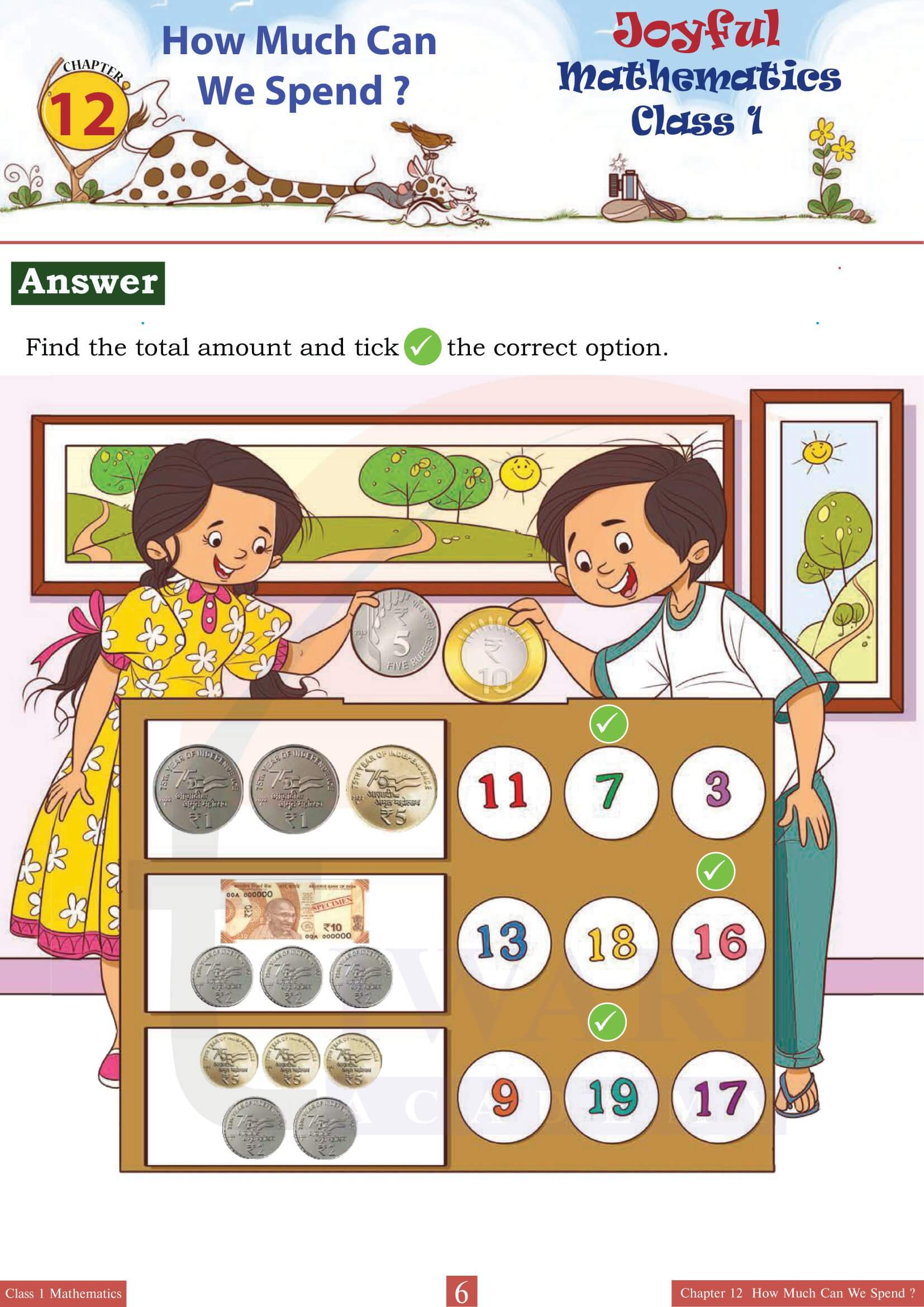

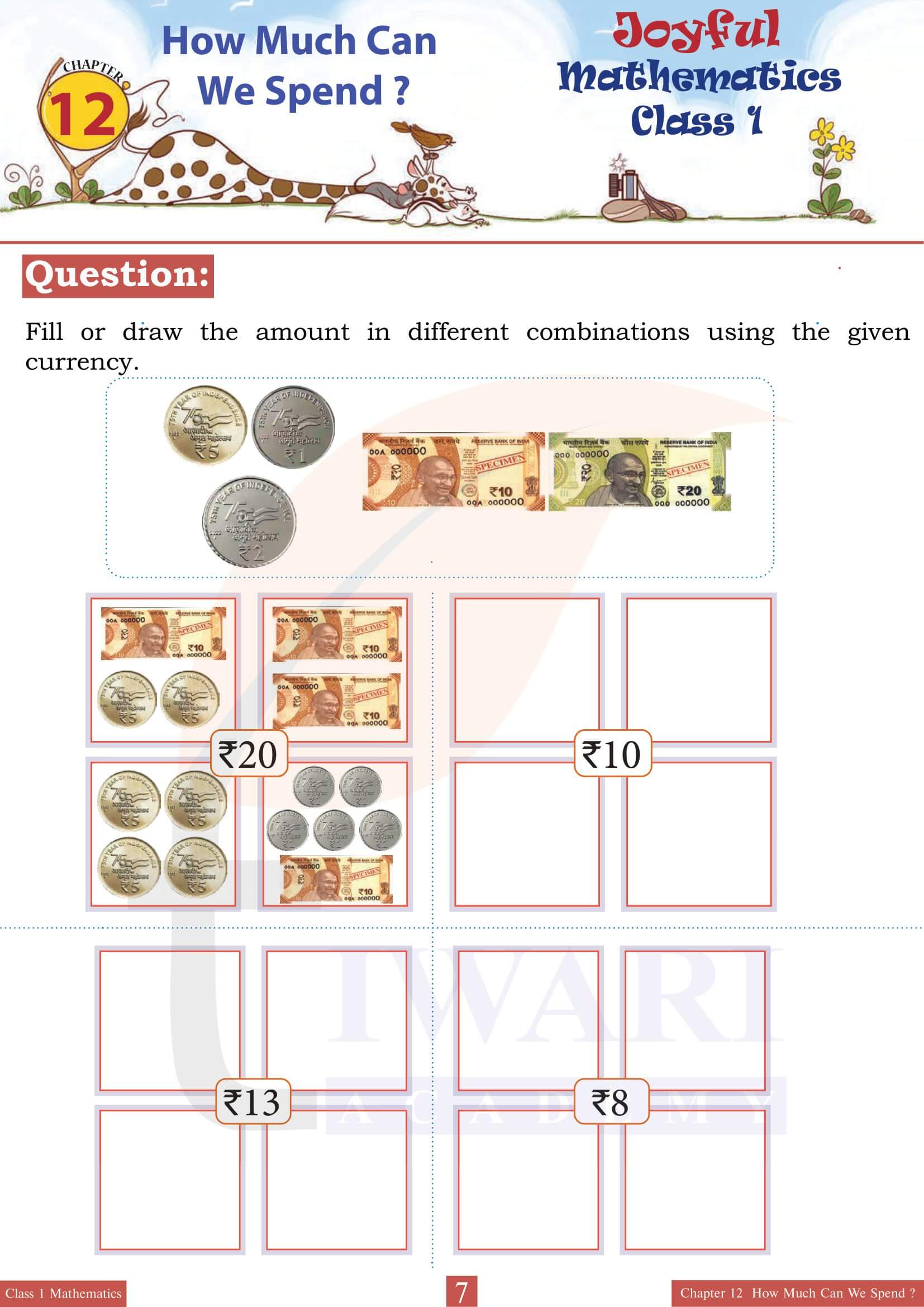

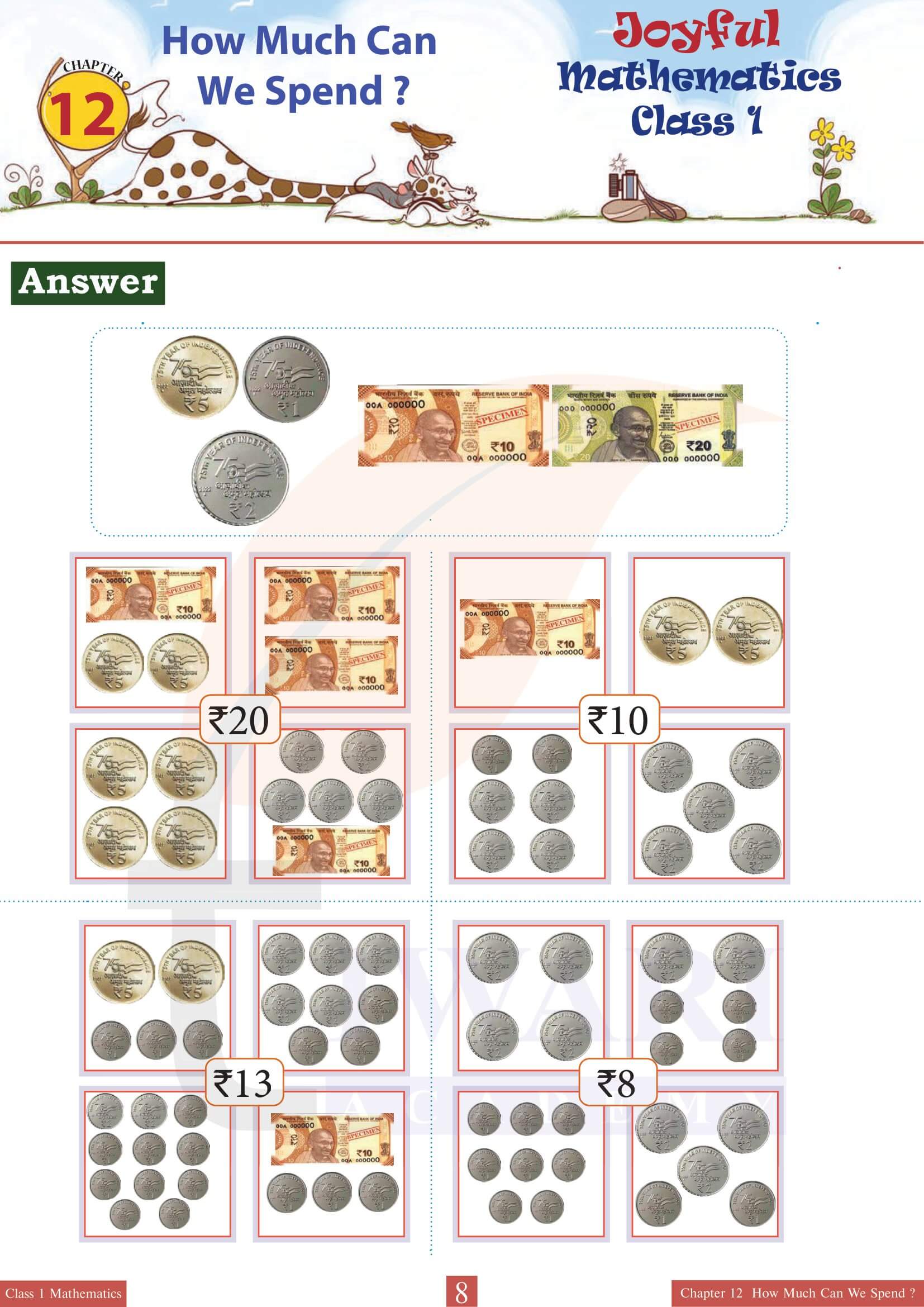

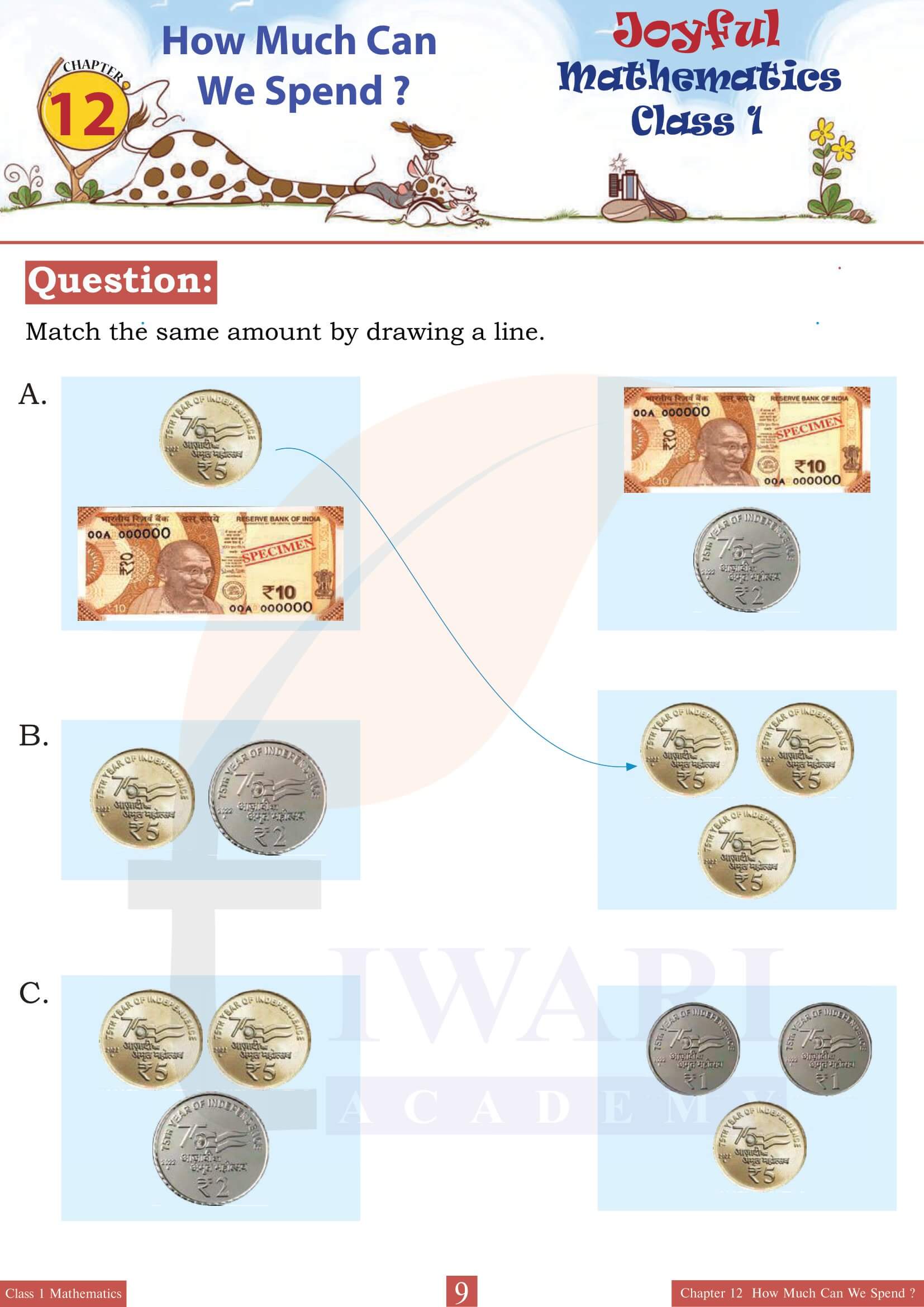

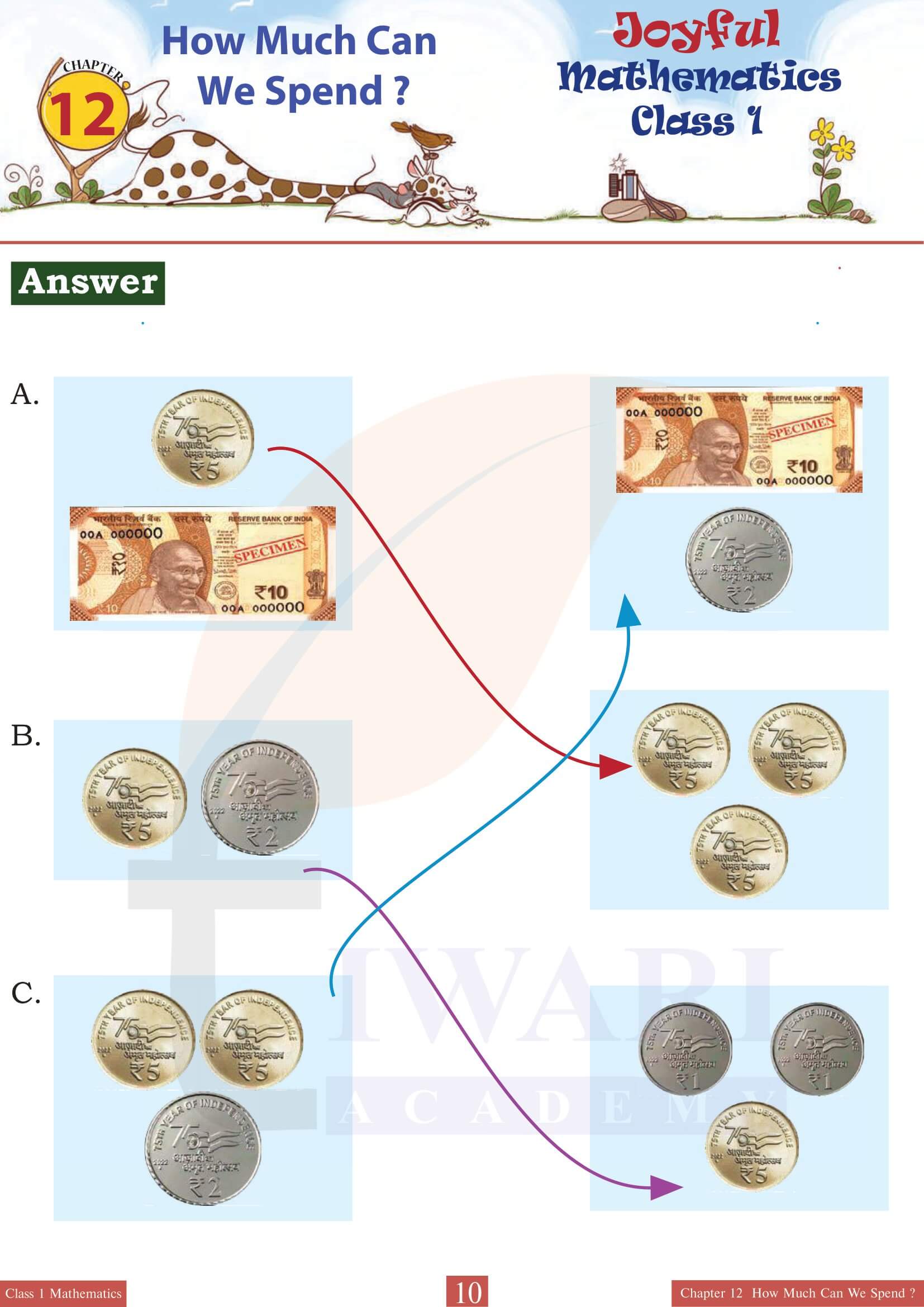

One of the key objectives of this chapter is to teach children about the denominations of currency, including coins and notes, that are commonly used. It explains how different items have different costs and how to use money to buy these items. The exercises include matching the amounts with the correct coins or notes and simple addition and subtraction problems to show how money is spent and change is received.

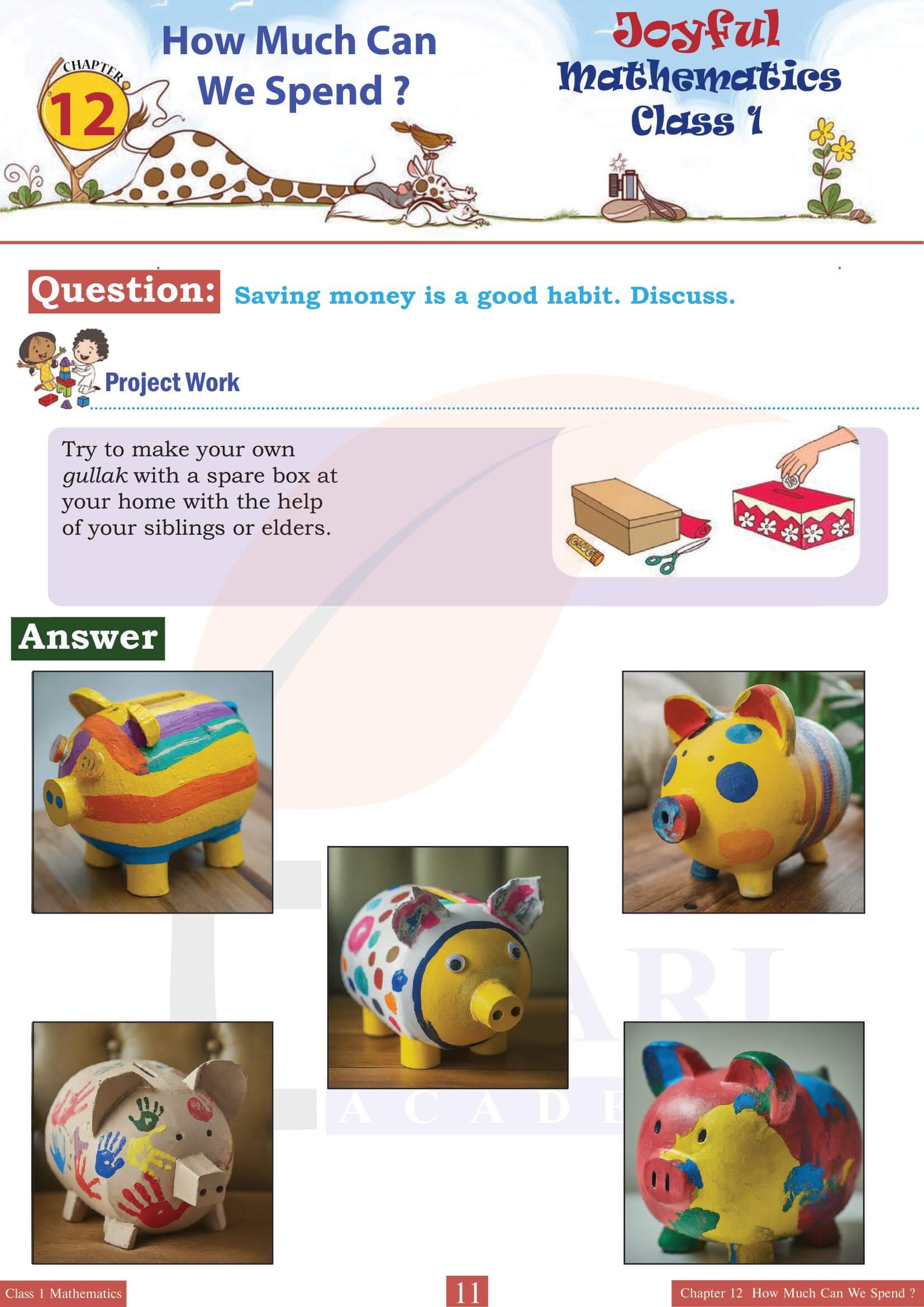

To further emphasize the importance of money management, “How Much Can We Spend?” introduces the concept of savings. It encourages children to think about saving money for larger goals or future needs, rather than spending it all at once. This is illustrated through stories or examples where a child saves a small amount of money regularly to buy something special, like a new toy or a gift for a family member. This not only teaches the value of patience and planning but also introduces the basic principle of savings as a part of financial literacy.

Interactive Activities in Chapter 12 of Class 1 Maths

Interactive activities are a significant part of Class 1 Maths Joyful Chapter 12, encouraging hands-on learning. For instance, children may be asked to role-play shopping scenarios where they have to make choices within a budget. This could involve using play money to buy items from a classroom “store” and calculating the total cost or the change they should receive. Such activities are instrumental in reinforcing the concepts taught, making learning both enjoyable and memorable.

Class 1 Maths Joyful Chapter 12 discusses the importance of making wise spending decisions. It encourages children to differentiate between needs and wants, helping them understand why sometimes it’s important to save money instead of spending it immediately. This is often presented through simple decision-making exercises where children have to choose between buying something they need versus something they want with a limited amount of money.

Understanding and Reinforce Learning

To assess understanding and reinforce learning, the chapter 12 of class 1 mathematics, concludes with a variety of exercises. These may include identifying the correct amount of money needed to purchase items, calculating the change returned from transactions and simple word problems that involve addition and subtraction of money. The exercises are designed to be engaging and are often presented in the form of puzzles or games to maintain the child’s interest.

Class 1 Maths Joyful Chapter 12 “How Much Can We Spend?” from the Class 1 Maths Textbook “Joyful Mathematics” lays the foundation for financial literacy among young learners. Through engaging stories, interactive activities and practical exercises, it introduces basic concepts of money, spending, saving and making smart financial decisions. Class 1 Maths Chapter 12 is crafted to make learning about money management an enjoyable and meaningful experience for children, setting the stage for more advanced financial education as they grow.